- Web3 on Fire

- Posts

- 🔥 US Shutdown – can they shut down UPTOBER too?

🔥 US Shutdown – can they shut down UPTOBER too?

Also: AdEx AURA Hackathon: $12K on the line for AI x Web3 big brain devs 👀

GM, frens! ☕️

Funny how perspective works.. you only realize how far you’ve come when you pause long enough to look back 🫡

Here’s what we’ve been watching this week:

🔥 US Shutdown – can they shut down UPTOBER too?

👀 AdEx AURA Hackathon: $12K on the line for AI x Web3 builders

🗣️ Ambire Rewards Season 1 – the community gets a say

🏎️ Did NASCAR nuke “Let’s Go Brandon” coin? A meme trial for the ages

🤓 Seconds to Zero – inside Galaxy’s breakdown of meme trading

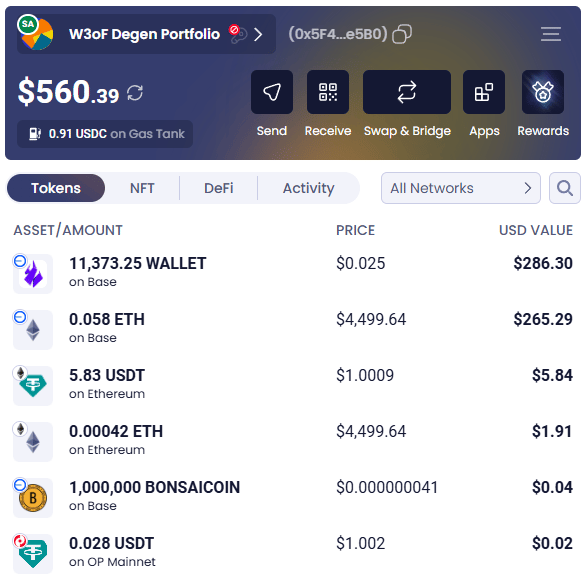

The W3oF Degen Portfolio is holding up with style. It’s not a sprint, but rather the kind of slow burn that sneaks up on you when you zoom out 👓️

We’re watching it unfold together in our 👉️ Discord 🙃

US Shutdown – can they shut down UPTOBER too?

October has always been crypto’s lucky charm. Traders called it “Uptober” because year after year, coins mysteriously pumped in the tenth month, no matter what the macro backdrop looked like 🤓

Why is October often so bullish?

The cause of “uptober” is quite simple: it is the beginning of Q4,and if markets have done well during the year, this forces sidelined tradfi capital into the market, needing to keep up with competitors and their own benchmarks. This is not just

— grimacexbt💹🧲 (@grimacexbt)

1:27 PM • Oct 2, 2025

This year was supposed to be different, though.

Uptober 2025 came with some new expectations, namely, the ETF machine 🎰

Instead of relying on internet meme magic, THIS TIME the market had real institutional flows to hang its hopes on. Many fresh spot ETFs were lined up at the SEC’s door 📜

The expectation was simple: October wouldn’t just be green because it always is. It would be green because crypto has reached new adoption milestones, regulations forecasts looked favorable and endless new ETFs were finally here and were about to kick the door down, leading to the big green long lasting bullrun 🐂

Then Washington went dark.

🎥 | The #USGovernment has shut down following a deadlock over the funding bill. Hundreds of thousands face job furloughs, essential services continue without pay, and millions of Americans are bracing for disruptions.

#TheStatesman

— The Statesman (@TheStatesmanLtd)

5:49 AM • Oct 1, 2025

A shutdown at the worst possible time

On October 1, the U.S. government shut down. That meant the SEC - the agency tasked with approving crypto ETFs - lost most of its staff. New filings can’t be reviewed and approval pipelines are locked 🙅

ETF traders had circled Uptober as the month when everything would break open. Now, the approvals are delayed indefinitely.

Looks like a prolonged government shutdown would definitely impact the launch of new spot crypto ETFs...

ETF Cryptober might be on hold for a bit.

From SEC's "Operations Plan Under a Lapse in Appropriations & Government Shutdown"...

— Nate Geraci (@NateGeraci)

4:38 PM • Oct 1, 2025

This isn’t just about crypto. IPOs, corporate registrations, and investigations across the financial sector are all frozen. But for crypto, where ETF flows have become the backbone of the 2025 rally, the timing couldn’t be worse 😐️

The government is shutdown??

— kira 👾 (@kirawontmiss)

4:28 AM • Oct 1, 2025

Here’s the question: without ETFs, does the current market have any real engine?

In past Uptobers, retail traders did the heavy lifting. Memecoins, alts, and pure momentum carried the market 🐸

During this one, it’s been institutions. Strategic reserves, spot ETFs for Bitcoin, ETH, and the pipeline of altcoin ETFs created a steady inflow. Custodians were absorbing coins off exchanges. That scarcity effect is what’s been pushing prices 🪙

6/

✧ Crypto reacts faster and more violently to uncertainty

✧ Expect short-term volatility if the shutdown delays macro signals

✧ Liquidity dries up, and fear-based selling kicks in

✧ But the deeper the dip, the sharper the rebound can be

— artikal (@0xArtikal)

5:32 PM • Oct 1, 2025

With the shutdown freezing approvals, we get to see how much of the rally is hype versus how much is structural demand.

Three likely paths from here

Delay but not cancel: the shutdown could be a pause, instead of a veto. Once government funding restarts, ETF approvals can move forward. Uptober’s rally may simply turn into a delayed November surprise 🤓

Narrative cracks: crypto loves its stories. If ETFs get stuck in limbo for weeks, traders may get restless, rotate into safer bets, or dump positions. Uptober’s “magic” could completely fade 🤯

Uptober goes old school: maybe the shutdown forces the market back to its roots. If retail traders and whales decide October must pump because it always has, you get a self fulfilling prophecy. ETFs or not, Uptober could just still run because simply “that’s what it should do” 🤷♂️

Oversight on ice

A shutdown doesn’t just block approvals, it puts the dogs to sleep too. With the SEC and others running skeleton crews, enforcement slows to a crawl. Investigations stall, filings gather dust, and the kind of scrutiny that keeps opportunists in check is suddenly absent 🥸

BREAKING🚨 THE SECURITIES AND EXCHANGE SEC OFFICIALLY SHUT DOWN

Does it mean they cannot halt any short squeezes 👀

$GME $AMC $MOASS— Umair (@umair235)

8:25 PM • Oct 1, 2025

That’s fertile ground for rugs, hacks, and various schemes.

It’s logical.. when the sheriff’s off duty, the Wild West gets wilder. And in a market already leaning on thin trust, one well timed bomb could do more damage than any delayed ETF 💣️

Thinking about the fragility of the current narrative: 2025 is the first cycle where adoption by institutions, ETFs, and (freshly gained) legitimacy from the perspective of the law were the engines. But it only takes a frozen bureaucracy in D.C. to reveal how dependent the market has become on those rails 🚆

Crypto has always prided itself on being borderless and unstoppable. Yet right now, the bull run lives and dies on the stamp of a bunch of U.S. bureaucrats that just went dark 🤔

So, can Washington cancel Uptober? Maybe not directly and right away, but it can show us just how thin the story really is. If ETFs are paused and the market still finds a way to pump, Uptober proves it’s still powered by belief. If not, then maybe this isn’t a bull run at all.. just an ETF waiting room dressed up as one 🙃

AdEx AURA Hackathon: $12K on the line for AI x Web3 builders

AI and crypto keep crashing into each other… and AdEx is putting $12,000 up for devs willing to get their hands dirty.

The AURA API Hackathon is now live, inviting devs to plug AURA into wallets, trading bots, chatbots, and anything else that can take a layer of AI smarts 🧠

The AdEx AURA API hackathon starts now!

It's time to build and compete for a share of the $12,000 prize pool ✨

Whether it’s an integration into wallets and chatbots or building something totally wild - we want to see what you can create!

Get all hackathon details below ↓

— AdEx.eth (@AdEx_Network)

1:14 PM • Sep 22, 2025

The setup is simple: fork the open source repo, ship something useful (or wild) 👀 and compete for the prize pool: $5K to the top build, with $3K and $1K for the runners up 💰️

Submissions run through October 22, reviews from the 23rd to the 28th, and winners land on October 30 ⌛️

For non devs, think of this as the experimental lab where tomorrow’s tools get sketched out. AI driven trading, smarter portfolio trackers, context protocols for big models… if you’ve wondered what happens when GPTs meet onchain tech, this is that test kitchen 🤖

If the last best thing was DeFi, the next wave could well be AI native crypto tools. AdEx is betting builders will sketch out that future in code this month 🧠

Ambire Rewards Season 1 – the community gets a say

Ambire Wallet isn’t hitting pause just yet. A governance vote is still live to decide whether Season 1 of Ambire Rewards should run until December 15, 2025 👀

It's time to govern Ambire ⚖️

We're presenting a series of proposals to enhance the accessibility and fairness of Ambire Rewards.

Calling $WALLET and $stkWALLET holders to join the discussion and voting ↓

— ambire.eth (@ambire)

2:12 PM • Oct 2, 2025

The mechanics stay the same: 20 million $WALLET tokens in rewards, distributed weekly to $WALLET and stk$WALLET holders. The only question is whether the community wants to stretch the season a little longer 🫡

Motivations behind the extension are simple: giving new users time to join, refine UX and eligibility rules, and keeping momentum while Ambire rolls out new features 🧠

So far, 109 token holders have voted (a new record for Ambire governance) 🤯 and with over 58% of votes already in favor, it looks like the community is leaning toward more time to earn and experiment 🤝

Governance isn’t always flashy, but it’s the backbone of any crypto project that’s more than hype.

Did NASCAR nuke “Let’s Go Brandon” coin? A meme trial for the ages

Only in crypto could a courtroom be tasked with deciding whether NASCAR is responsible for killing a meme coin tied to a political slogan 🤨

Yet that’s exactly what’s unfolding as the Let’sGoBrandon Foundation drags NASCAR into court, claiming its abrupt U-turn on a sponsorship deal cost the project hundreds of millions of dollars 🤯

Yes, money lost on a degen meme coin. The trial is every bit as absurd as it sounds.

With even more revelations of crimes against conservatives coming to light this week, watch long awaited justice get served against NASCAR in our $80M promissory estoppel trial beginning tomorrow in Miami

youtube.com/@letsgo-founda…

— LetsGo (@LetsGo)

5:15 PM • Sep 28, 2025

“Let’s Go Brandon” started at a NASCAR race in 2021, when chants of “F** Joe Biden” 🫠 were picked up on live TV and misreported by a flustered reporter as “Let’s go Brandon”

The phrase went viral as a political slogan, and inevitably, someone minted a coin. LGBcoin was born, part of the degen sub genre known as PolitiFi memes, where politics and degen tokenomics collide.

The sponsorship that didn’t come to be

In late 2021, the foundation struck a deal to plaster LGBcoin branding across NASCAR driver Brandon Brown’s car and gear. Court filings show NASCAR staff initially gave the green light. The foundation went public, issued press releases, and of course the token pumped 💰️ 💰️

NASCAR’s Brandon Brown, who the “let’s go brandon” phrase was named after, finally landed a major sponsor, and now has his own “let go brandon” racecar. 😂 Take THAT b!den! 😂

— 🇺🇸ProudArmyBrat (@leslibless)

12:07 AM • Dec 31, 2021

Then NASCAR walked it back and refused to officially approve the sponsorship.

According to the foundation, this vaporized $76 million in value in a day, and more than $380 million by the end of the month. Degens who thought they were riding political momentum straight to the moon instead found themselves with bags of digital rubble 🤒

The foundation argues they were misled - that NASCAR’s mixed signals and initial approval email made them believe the deal was locked in.

NASCAR counters that no binding contract was ever signed and that its rulebook allows it to rescind sponsorships. Officials even testified that they didn’t realize “LGB” stood for “Let’s Go Brandon” until after the fact 😶

Brandon Brown himself admitted he was warned the sponsor might divide the fanbase. Which, in hindsight, feels like an understatement.

This is THE biggest story right now in motorsports!

Real patriots are battling @NASCAR in court today! Bombshell Testimony where a NASCAR exec admitted approving the sponsorship and @brandonbrown_68 himself testified that the deal was sealed!— Greg J. Marchand MD (@MarchandSurgery)

10:11 PM • Oct 1, 2025

The absurdity runs deeper. Imagine lawyers presenting charts showing how a meme coin’s market cap went from nine digits to zero because a logo never made it onto a stock car. Imagine jurors being asked to weigh reputational damage in the world of political meme tokens. This is what’s on the table 🤦♂️

But if anything, this only highlights something crypto natives already know.

That markets built on vibes and memes are brutally fragile. A single corporate reversal can trigger a cascade that wipes billions. For every dog meme that survives, there’s a graveyard of half baked tokens undone by a sponsorship deal, a tweet, or a rug 🤷♂️

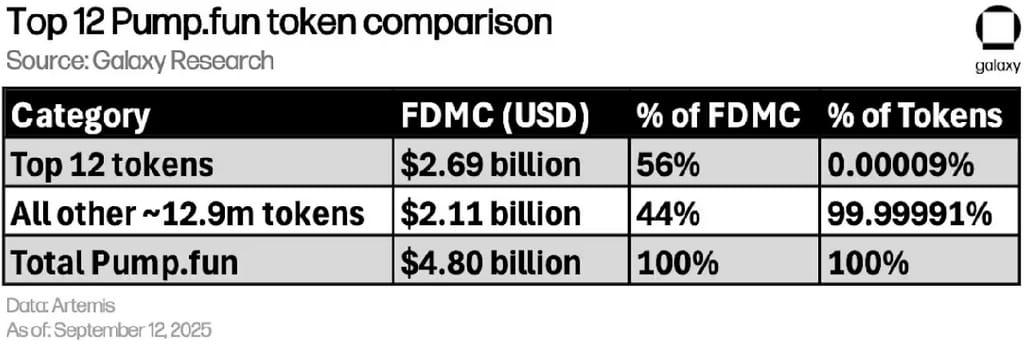

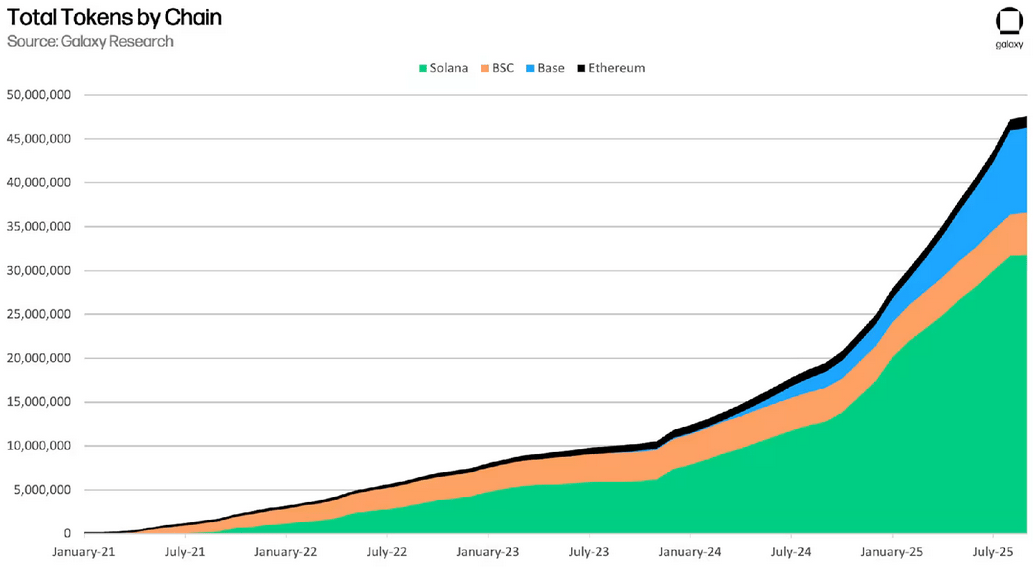

Seconds to Zero – inside Galaxy’s breakdown of meme trading

Memecoins aren’t dying, they’re multiplying.

Galaxy Research just dropped a fat report on the sector, and the takeaway is simple: the casino doesn’t close, it just keeps adding different slot machines 🎰

New from @glxyresearch: @owenswill14 surveys the wild world of memecoins and offers some astonishing stats. Link in replies...

— GalaxyMarc (@MarcAtGalaxy)

2:57 PM • Oct 1, 2025

Perpetual degens

The January 2024 launch of Pump.fun flipped the economics of token creation. What used to take connections, devs, and time now takes nothing more than $30 and a few clicks 📱

Result: Solana’s token count ballooned from under 8 million to 32 million in less than a year, with 12.9 million of those straight out of Pump.fun 🤯

Despite the flood, value is hyper concentrated. Twelve tokens capture more than half the FDV. It’s textbook power law math, a microscopic minority carry all the weight, while 99% of the roulette wheel spins into zero 🌎️

Median hold times on Solana have collapsed to ~100 seconds. A year earlier it was 300+. Automation, bots, and sniper tools have pushed this further. Some wallets are scalping trades faster than you can refresh Dexscreener.

This isn’t “investing” per se, more like Counter Strike with charts 🔫

And the interesting bit is that all in all, the infrastructure becomes the real winner: launchpads, bot makers, perp venues. Tokens themselves simply become the bait 😲

Solana has the cheap gas to stay the meme factory while BNB and BASE play second fiddle with pure volume, while Ethereum has become a museum for older, more bulky memes.

For a short while, Pump.fun has also nearly lost ground to Bonk.fun but clawed it back.

Risks - honeypots and rugs

Galaxy doesn’t sugarcoat it: memecoins remain a pit of honeypots, vampire liquidity drains, and coordinated KOL shill-n-dump operations. Median hold times and liquidity flows guarantee most traders lose, while a rotating minority hit jackpots. The fragility is structural... one crackdown, one scandal, and the sector gets a cold shower 👎️

Galaxy highlights “Project Ascend”, a sliding fee model that taxes small creators harder and rewards whales at scale. Kind of like Patreon, but the patrons are bots and the art is actually sh^@coins. It’s the meme economy formalized: creators pump, degens dump, infra skim 🤨

The TLDR

Memecoins now represent tens of millions of tokens and billions in FDV.

The culture’s not going anywhere.

Because it doesn’t need mass adoption, it only needs enough gamblers to keep the lights on. The house always wins, but every once in a while a degen hits a jackpot big enough to keep the myth alive 🤷♂️ in other words, the entire sector survives on a loop the same churn, the same cycles of hype and rug and launchpads spitting out copy paste tokens at industrial speed 🔧

Galaxy’s numbers don’t show innovation as much as they show scale: millions of coins minted, hold times shrinking to seconds, and liquidity moving like casino chips from one table to the next.

Other worthy reads

“Exciting stuff this week” - according to 0xJeff:

Exciting stuff this week

- @Plasma as liquidity hole last week sucking everything with 30-100% APY stable farming ops with massive XPL incentives

- Lending protocols TVL massively went up as a result (@aave , @0xfluid )

- Seeing glimpse of Defi x AI action where @ZyfAI_

— 0xJeff (@Defi0xJeff)

11:00 AM • Sep 30, 2025

“Will all L1s move to Ethereum?” by Hazelflow:

x.com/i/article/1973…

— Hazeflow (@hazeflow_xyz)

12:36 PM • Oct 1, 2025

“The stablecoin duopoly is ending” by Nic Carter:

x.com/i/article/1973…

— nic carter (@nic__carter)

2:48 PM • Oct 1, 2025

MEMES

"and once we get to Q4 then we'll all be rich because Q4 is always bullish, right George?"

— Tony (@0xRacist)

2:30 PM • Sep 26, 2025

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!