- Web3 on Fire

- Posts

- Zero to 90 - why this cycle could go NUCLEAR

Zero to 90 - why this cycle could go NUCLEAR

Plus: 160 Billion reasons DeFi owns this market

GM, frens! ☕️

Every year here teaches the same lesson (in a different costume): nothing here is permanent. Be it good or bad stuff 🙃

Here’s what we’ve been watching this week:

💣️ Zero to 90 - why this cycle could go NUCLEAR

💵 160 Billion reasons DeFi owns this market

🏠️ Crypto pumps Trump’s wealth past his real estate empire

🚗 Toyota’s robotaxi vision - mobility becomes the next yield farm

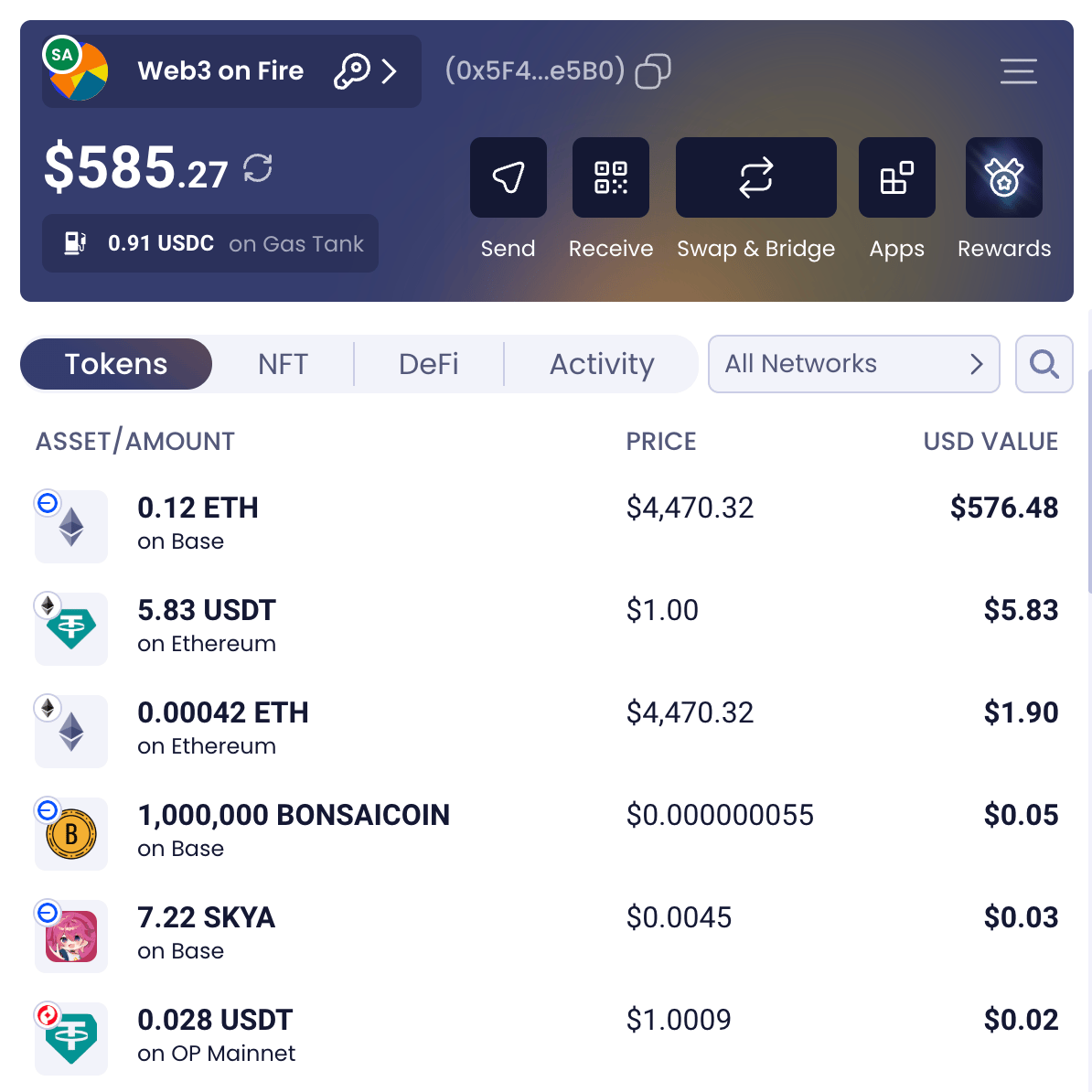

The W3oF Degen Portfolio mirrored that truth, small changes here and there, nothing spectacular, but proof it’s still in motion.

Don’t forget to join the discussion in our Discord btw 🤓

Zero to 90 - why this cycle could go NUCLEAR

Once upon a time, crypto begged for just one thing…. an ETF 🤨

Years of rejection, political theatre, and endless “two more weeks until approved bro” headlines left the industry clinging to that first spot ETF approval like it was the key to the kingdom 🗝️

Now though, the SEC’s inbox looks like a spam folder, as they have 90+ applications stacked up 🤯

The list is led by XRP and Solana, but padded with everything from serious altcoins to turbodegen meme garbage 👇️

NEW: Here is a list of all the filings and/or applications I'm tracking for Crypto ETPs here in the US. There are 92 line items in this spreadsheet. You will almost certainly have to squint and zoom to see but best I can do on here

— James Seyffart (@JSeyff)

8:57 PM • Aug 28, 2025

The new face of legitimacy

Tradfi used to roll eyes at crypto.

Today, the same firms are queuing up to ‘financialize’ every ticker they can get their hands on. ETFs aren’t about culture or tech. They’re wrappers, fee machines, Trojan horses if you will, that carry crypto exposure 🫱

That’s the point. They’re not just talking about BTC and ETH anymore. In the close future, it could be your favorite BONK-whatever-inu, or Trump / other politically branded tokens, and even half forgotten alts being suited up for a chance at mainstream flows. It’s surreal, but it also signals that the old markets aren’t just warming up to crypto, they’re about to choke on it 😲

The supercycle theory, reborn

For years, “supercycle” was the hopium pitch of every bull run, the idea that crypto would stop following four year halvings and go parabolic for good 👆️

It never quite stuck. But watching the waves build in this cycle, it suddenly doesn’t sound so far fetched.

Seeing talk of a Bitcoin “Saylor Super Cycle” - essentially an Institutional Super Cycle, so here’s an idea I’ve floated before on how that could unfold.

It’s just a theory. Way too many variables to call it more than that.

But as we get favorable US regulations, ETF flows,

— Bob Loukas 🗽 (@BobLoukas)

3:49 PM • Jun 16, 2025

Imagine an old school equities desk in New York scrolling through fund options: “Oh right, here they are: Apple… Exxon.. Obama Sonic Inu ETF..” 🤔 the juxtaposition alone is crazy, but it’s coming.

Bloomberg analysts @JSeyff & @EricBalchunas now say there’s a 90–95% chance the SEC approves Spot ETFs! 🚨

Confirmed front-runner?

Litecoin ($LTC)

The digital silver is about to shine brighter than ever. 🌕

— Santolita (@SantoXBT)

8:48 AM • Jul 2, 2025

This oversaturation isn’t necessarily bullish for every coin. Half of these funds will die from lack of inflows, dragging names down with them. But the aggregate effect could stay 🧠

Old markets drowning in crypto wrappers, buyers hearing “ETF” and assuming safety, firms sneaking in exposure under the guise of diversification 🪙

Crypto is becoming inescapable - woven into every portfolio, every brokerage dashboard, every macro conversation.

And though the supercycle might not arrive in the way maxxis once imagined, because it won’t be halving cycles dictating price charts, it will still be like a slow suffocation of traditional finance under an avalanche of filings, approvals, and inflows until crypto isn’t “alternative” anymore 🫡

So yeah, when the SEC’s desk looks like this, you realize the question was never “if” it was “how many” and the answer, apparently, is: too many to ignore 💰️ 💰️

160 Billion reasons DeFi owns this market

… but while ETFs and a bunch of other BS like celebrity coins and court shenanigans were farming everyone’s attention, DeFi kept doing what it does best: stacking money, building rails, and compounding under the surface 💵

Q3 sealed it - total value locked pumped 41%, smashing past $160B for the first time since 2022 🤯

Ethereum carried the charge like a heavyweight. In July, ETH DeFi sat at $54B. By September it was nearly $100B. That’s a double up in two months.

Solana wasn’t slacking either, clocking a 30% climb while the chain’s degen culture kept churning out activity.

Aave swelled to $41B locked, Lido posted $39B, and Eigenlayer doubled itself into the $20B club like it was nothing.

And then Arbitrum walked in with the stimmy check.

Introducing DRIP - The DeFi Renaissance Incentive Program!

A huge DeFi program that rewards real DeFi actions on Arbitrum, starting with Season 1: Leverage Looping Strategy

💧 Deposit ETH/stables

💧 Borrow & loop

💧 RepeatJoin the Renaissance now 👇

arbitrumdrip.com

— Arbitrum (@arbitrum)

1:06 PM • Sep 3, 2025

ARB’s new DRIP program is splashing $40M worth of incentives across the ecosystem. Borrow here, loop there, farm everywhere 💰️

On top of that, $14M set aside for audits. That’s like tossing free chips on every blackjack table. Degens get their rewards, builders get their security, and Arbitrum gets the volume 🧠

Meta inside the meta

Here’s the good part: this isn’t even synced to the rest of crypto’s narrative.

Bitcoin boomers hog the old media/TV coverage, Trump’s rugs and random memes farm the attention economy, and yet DeFi’s out here running its own lap. A cycle inside the cycle. Stealthy. Patient. Moisturized. Flourishing.

And for anyone still pretending to be “done with DeFi”? Please. The same people who rage quit in 2022 are back in Discords asking about strats and peeking charts at 3am again. Nobody ever really leaves.

Crypto pumps Trump’s wealth past his real estate empire

Donald Trump always promised to make America rich again.. and it seems his own pockets were as good a starting point as any.

The Trump family’s crypto holdings fattened by a casual $5.6 billion (unrealized) this week, thanks to the debut of World Liberty Financial’s token (WLFI) 🤯

Pure Trump tier: launch a financial vehicle wrapped in patriotic branding, make sure the family takes the lion’s share, and then let the market do what it does best - spin the hype into numbers big enough to splash across headlines.

🚨The Trump family’s net worth surged by roughly $5 billion following the launch of the $WLFI token under their crypto venture, World Liberty.

While Trump holds the title of “honorary co-founder,” his three sons are listed as co-founders.

The family collectively owns less

— Brian Rose, Founder & Host of London Real (@LondonRealTV)

4:25 AM • Sep 2, 2025

The Trumps now control 22.5 billion WLFI, nearly a quarter of supply, plus equity in the holding company that skims profits from token sales.

In one stroke, the family’s digital portfolio dwarfed the decades old real estate empire that built the brand in the first place 🪙

WLFI opened trading around $0.30 and quickly slid toward $0.25, but the valuation math still towers over the presale days. At $0.05 per token, the family’s holdings were worth $1.1 billion, which is still a lot. At today’s numbers though, they’re sitting on a paper windfall five times that size 🤌

Trump family's crypto holdings now dwarf their real estate empire—$12 billion in digital assets versus $3 billion in traditional property.

World Liberty Financial alone holds $400M across [ $ETH ], [ $WBTC ], and stablecoins, while the [ $TRUMP ] memecoin allocation sits at

— Fish4AI (@Fish4AI)

3:46 PM • Sep 4, 2025

The difference here is that WLFI isn’t playing the part of a throwaway meme coin, it plugs into DeFi infrastructure, runs on Ethereum and taps into Aave for lending and borrowing.

The protocol has governance rights, revenue streams, and even its own stablecoin, USDI, which has already been ranked among the top six globally with a $2.6B market cap. In other words, it’s trying to look less like a gimmick and more like a heavyweight DeFi protocol (albeit one with Trump’s face stamped on the cover) 🍊

Plus there’s more than one purpose. For the MAGA cult faithful, WLFI could be a rallying point, a chance to turn political loyalty into onchain conviction 👇️ t

#BREAKING

WLFI predicted to hit top 10 on Coinmarketcap!

I never seevsuch a large volume of pre-market trading.

#MAGA bullish on World liberty finance @worldlibertyfi#USD1 🔥

Where are the $WLFI army, let’s connect and Follow each other!!

#USD1

#Trump#crypto— Phunk369 (@PhunkUltras)

12:29 AM • Jun 25, 2025

For traders, it’s another play with the Trump brand acting as liquidity bait 🤷♂️

80% of the $TRUMP memecoin supply sitting in a single wallet is yucky

The $MAGA and $DJT tokenomics by his children are even more yucky

The $WLFI Trump DeFi project is just a straight up scam

But at the same time there is no question that it's very bullish for crypto that the

— Leonidas 🧡 $DOG (@LeonidasNFT)

12:14 AM • Jan 19, 2025

And for the family at the center of it all, it’s a sign that political capital and financial capital aren’t so different when the line between meme culture and market structure keeps blurring 🥸

This is the guy who once sold steaks, btw.

proof of steak

And now his family’s selling access to his “slice of crypto wealth”. To be honest, that might be the most Trumpian product of all, if you think about it.

Toyota’s robotaxi vision – mobility becomes the next yield farm

Toyota has been selling cars for almost a century. Now they’re trying something that sounds kinda out of the character: turning cars into tokenized assets.

🚨 LATEST: @avax and Toyota Blockchain Lab are planning the infrastructure for onchain mobility and maybe even robotaxi fleets. 🚕

Avalanche and Toyota’s forthcoming MON network will open the gateway to new emerging use cases.

— CryptosRus (@CryptosR_Us)

9:30 PM • Sep 2, 2025

Together with Avalanche, they’re sketching out the infrastructure for fleets of autonomous robotaxis, but instead of Uber-likes pocketing the ride fees, the value gets spun across a blockchain network 🤔

Though it’s beyond self driving tech.

Avalanche and Toyota’s “Mobility Orchestration Network” wants to make every layer of car ownership onchain: financing, leasing, insurance, even carbon credits 💰️

I.e they want the car parked outside to be more than just depreciating metal, they want them to be a yield bearing asset with tokens that trade hands as easily as shitcoins 🐸

Sounds… exciting to say the least, but also raises some questions: who regulates ownership when a “car” is 30% tokens, 20% insurer stakes, and the rest split across random wallets?

Do you sue a DAO if your robotaxi crashes into a lamppost? And are we really ready to let people crowdfund fleets of onchain taxis, or does that just create the next wave of speculative bubbles with wheels? 🚗

Especially considering that the electric vehicle markets and taxi markets both aren’t feeling too well after COVID subsided 😷

Toyota whitepaper:

"We chose Avalanche because its design centered on multiple L1s (formerly Subnets), its fast finality, and its native ICM align with MON’s philosophy of building locally, collaborating globally."

— Luigi D'Onorio DeMeo 🔺 (@luigidemeo)

10:46 AM • Aug 23, 2025

Anyway, there could be probably more questions, but it’s clear it’s just too early to ask these at the moment.

Still, the idea that mobility itself could be tokenized is bigger than it looks. DeFi already turned onchain collateral, bonds, treasuries, real estate into a multi billion dollar game. Why not cars? 🧠

Other worthy reads

“The dark side of prediction markets.” by Splin Teron:

x.com/i/article/1961…

— Splin Teron (@splinter0n)

6:58 PM • Aug 31, 2025

“How much is your "life changing money"?” by 2Lambroz

x.com/i/article/1962…

— 2Lambroz 🐑 (🧑🍳🥩🤌) (@2lambro)

5:42 AM • Sep 1, 2025

“The Influence Meta” by Polyglot:

x.com/i/article/1960…

— Polyglot (@0xpolyglot)

4:11 PM • Aug 26, 2025

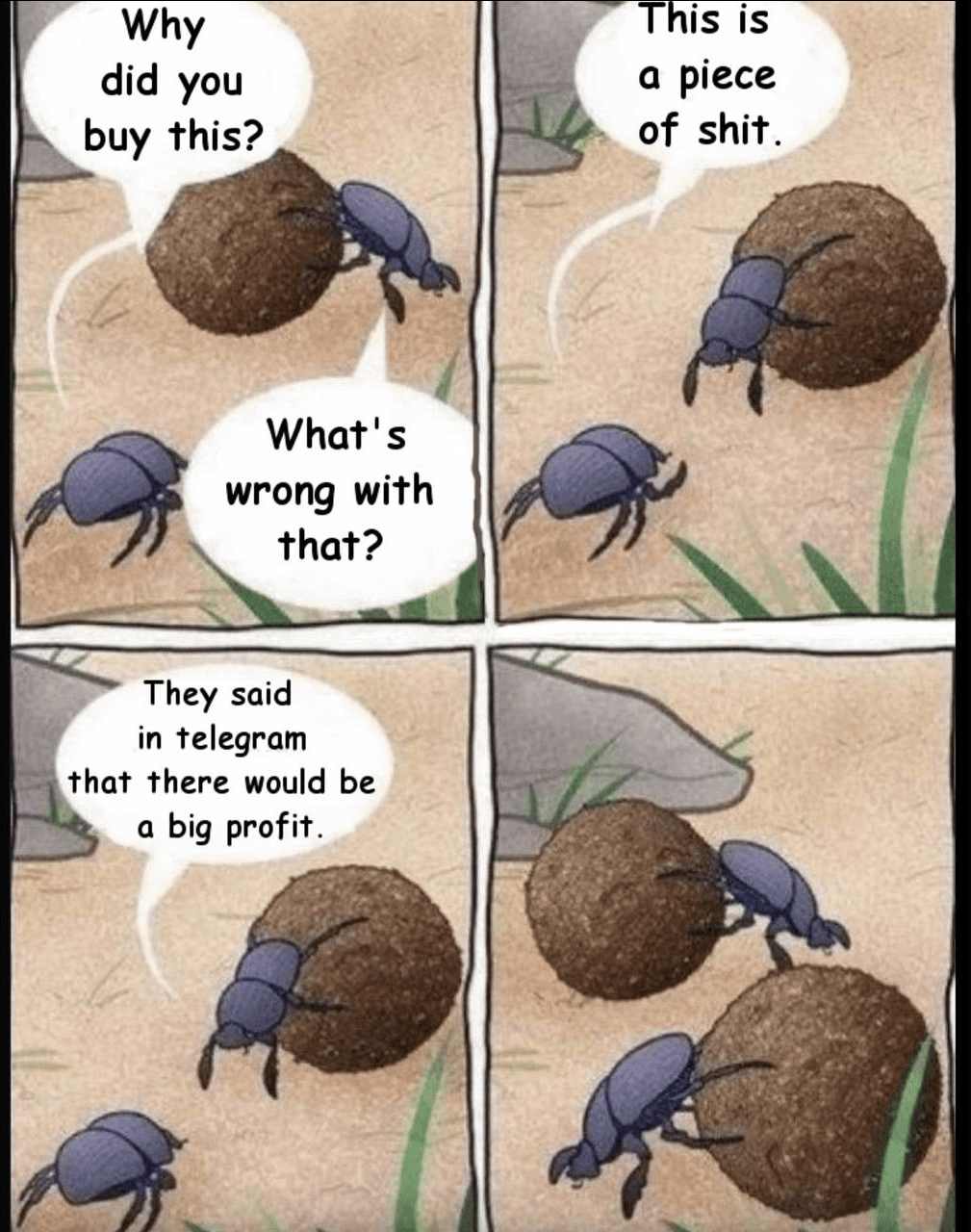

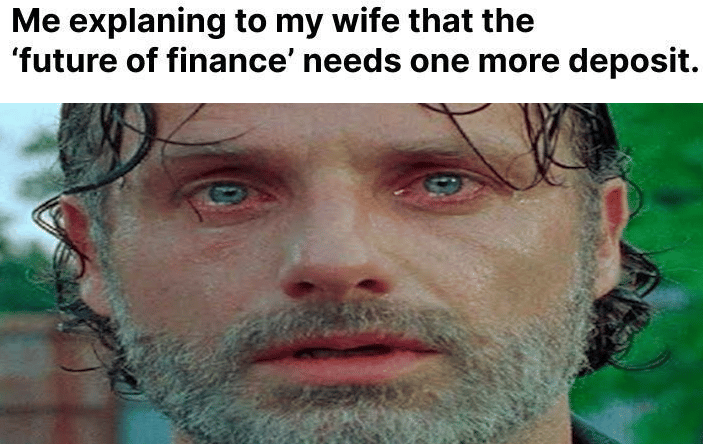

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!