- Web3 on Fire

- Posts

- 🔥 “BNB Szn” proved the market’s still addicted to pain

🔥 “BNB Szn” proved the market’s still addicted to pain

Plus: Ethereum’s latest privacy push has very familiar DNA 👀

GM, frens! ☕️

Progress doesn’t always shout. It creeps in slowly and quietly, hiding behind small wins and uneventful weeks 🤔

But if you zoom out, it’s hard not to notice how far things have actually come. What felt like chaos at the time was just the groundwork for what’s next 🫡

Here’s what we’ve been watching this week:

💊 “BNB Szn” proved the market’s still addicted to pain

👀 Ethereum’s privacy push and the familiar DNA

🟢 Prediction Markets meta update: activity reaches ATH

🥷 UK court jails a degen for turning covid business relief into a crypto bet

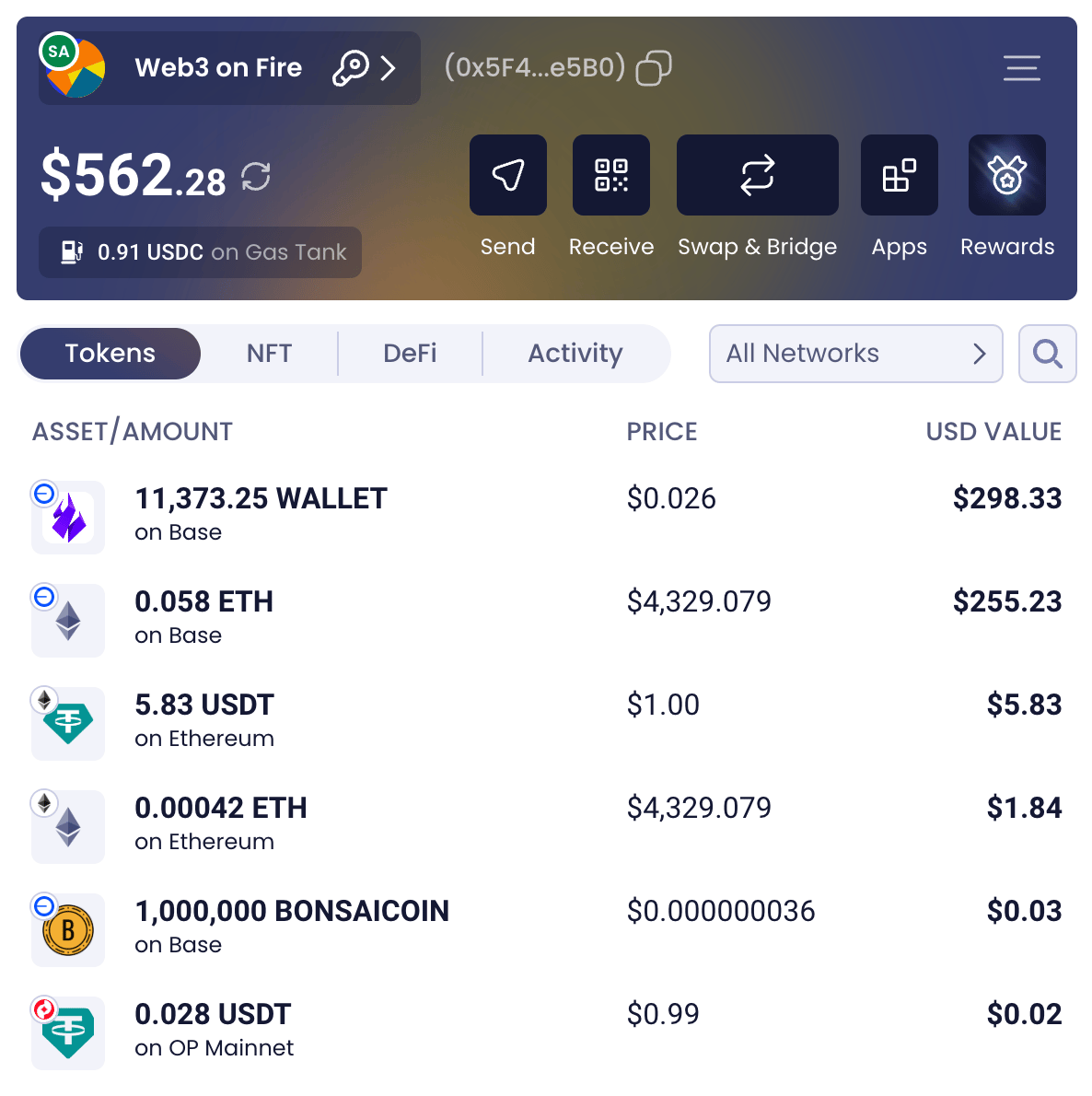

The W3oF Degen Portfolio stayed balanced through it all - steady footing while everything keeps evolving.

And it’s true that the view gets a lot better when you take a step back.

Join us in the Discord: the view’s better when you’re not staring at the one minute chart alone 🤗

“BNB Szn” proved the market’s still addicted to pain

After years of being ignored, Binance’s native chain started humming again. BNB broke through $1,330, its highest level ever, up nearly 50% in a month. Trading activity spiked across the ecosystem - $80 billion in PancakeSwap volume in September alone - and total value locked on the chain jumped by a billion dollars in a week 💵

For many in the space that was old muscle memory kicking in.

2021 all over again? Cheap tokens, fast blocks, and a community that didn’t care what it was buying as long as it moved 🤔

Back then, BNB was the launchpad for an entire generation of gamblers, experimental projects, outright sh^&coins. And this time, too it came back wearing the same old costume. Memecoins, of course.

And just as traders started paying attention, something else began to rise - a new category on CoinGecko labeled “Made in China”.

main trends of the day on english ct:

- polymarket

- monad

- bnb/chinese/pancakeswapmain trends on chinese ct:

- binance/aster/bnbchain/bsc/@heyibinance /fourthe common theme is clear.

besides bnb,aster,cake, mostly memecoins are trending currently like 4, giggle, palu and

— Crypto Koryo (@CryptoKoryo)

1:17 PM • Oct 9, 2025

It was a strange mix of tokens with loose ties to Asia: BNB, Mantle, Aster, and a growing list of knockoff memes.

They pumped together, outperforming almost every other narrative on the board. The “China coins” basket jumped 5.2% in just a few hours, while the broader market slipped into red 🧺

"Made in China" leading the @coingecko categories in the past 24hrs and past 7 days.

it's that simple

— Presto Research (@Presto_Research)

2:07 PM • Oct 6, 2025

The gamblers didn’t need much convincing. This momentum was picking up fast 🏃

Over 100,000 wallets piled into BNB memecoins within a few days. PancakeSwap’s volume exploded. The community started calling it the “China season” and “BNB season”.

And for a brief moment, it really looked like the chain was alive exactly like “back in the day” 👇️

#BNB meme szn! 😆

I didn't expect this at all. And people keep asking me to predict the future... 🤷♂️

Keep building!

— CZ 🔶 BNB (@cz_binance)

4:15 PM • Oct 7, 2025

CZ supported the new meta by posting “BNB meme szn” on X, and his post seemed to be the match that hit the powder 💣️

Within hours, prices jumped again. The “Made in China” coins went vertical. Traders called it validation - “the godfather had spoken” 🫠

Then, barely a day later, CZ walked it back:

Good advice 👇

For a brief time, I tried avoiding meme related content in my tweets. Impossible. Too many memes exist, and it made my writing unnatural.

Now I just tweet normally, any overlap to memes is coincidental, not endorsement.

— CZ 🔶 BNB (@cz_binance)

9:55 PM • Oct 8, 2025

And just like that, the music stopped.

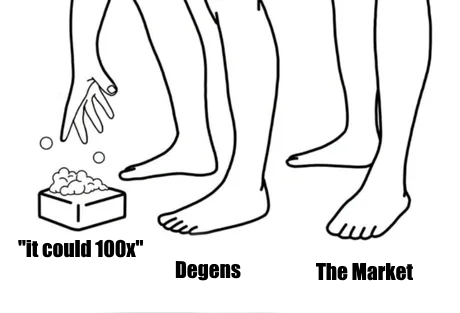

In 24 hours, most BNB based memecoins lost 60–95% of their value. A few lucky ones managed to exit near the top, but the rest were left holding bags.

Needless to say, this made some in the community incredibly upset.

Send CZ back to jail

— LilMoonLambo (@LilMoonLambo)

9:45 AM • Oct 9, 2025

BNB had seen this movie before, in 2021, when every coin with a dog or a farm printed 100× before vanishing. But this time, even with this short wave, there was something emptier about it 😐️

The fundamentals for the chain itself were fine. Better, even. The chain was healthy, volumes strong, new projects live. Yet the energy felt off.

I just don’t understand, we had a legitimate meme super cycle on our hands

100 mill runners spawning left and right, retail texting me for the first time in years

Binance wakes up and says yes let’s end this all now!? Let’s rape all the coins on our eco that have made us

— cousin (@cousincrypt0)

9:19 AM • Oct 9, 2025

The players were chasing a feeling, the one they had when crypto felt infinite, when PancakeSwap was new and the charts never stopped.

So yes, BNB hit a record high, memecoins pumped, traders lost millions, and life went on.

Because this kind of thing just changes faces, puts on new memes, and keeps haunting whoever’s still willing to believe 🤦♂️

Ethereum’s privacy push and the familiar DNA

Ethereum Foundation circled back to Kohaku - the privacy framework aiming to make Ethereum’s next layer of wallets smarter about what they reveal 🧠

1/ It’s time for us to go public so you all can go private, and it’s time for us to be bold so you all can be safe.

As part of our work with the @ethereumfndn, @VitalikButerin and I are proud to be the faces of Kohaku. 🧵👇

— Nico (@ncsgy)

8:17 AM • Oct 9, 2025

The project is building on Ambire’s code, a signal that the foundation prefers proven ground over experimentation. And honestly, having your code form part of Ethereum’s new privacy is proof that diligent dev work, not empty hype, still moves the real progress forward 🔧

And if Ambire’s existing stack meets that bar, there’s plenty more under the hood worth paying attention to 👀

Digital freedom cannot exist without privacy.

As our lives increasingly exist online and onchain, protecting privacy by design represents a necessity.

Ambire is proud to be forked for the Kohaku project and to collaborate on bringing privacy home to Ethereum.

Privacy is for

— ambire.eth (@ambire)

8:40 AM • Oct 10, 2025

Ethereum’s privacy era isn’t coming, it’s here. And Ambire’s proud to have helped write the spec 🫡

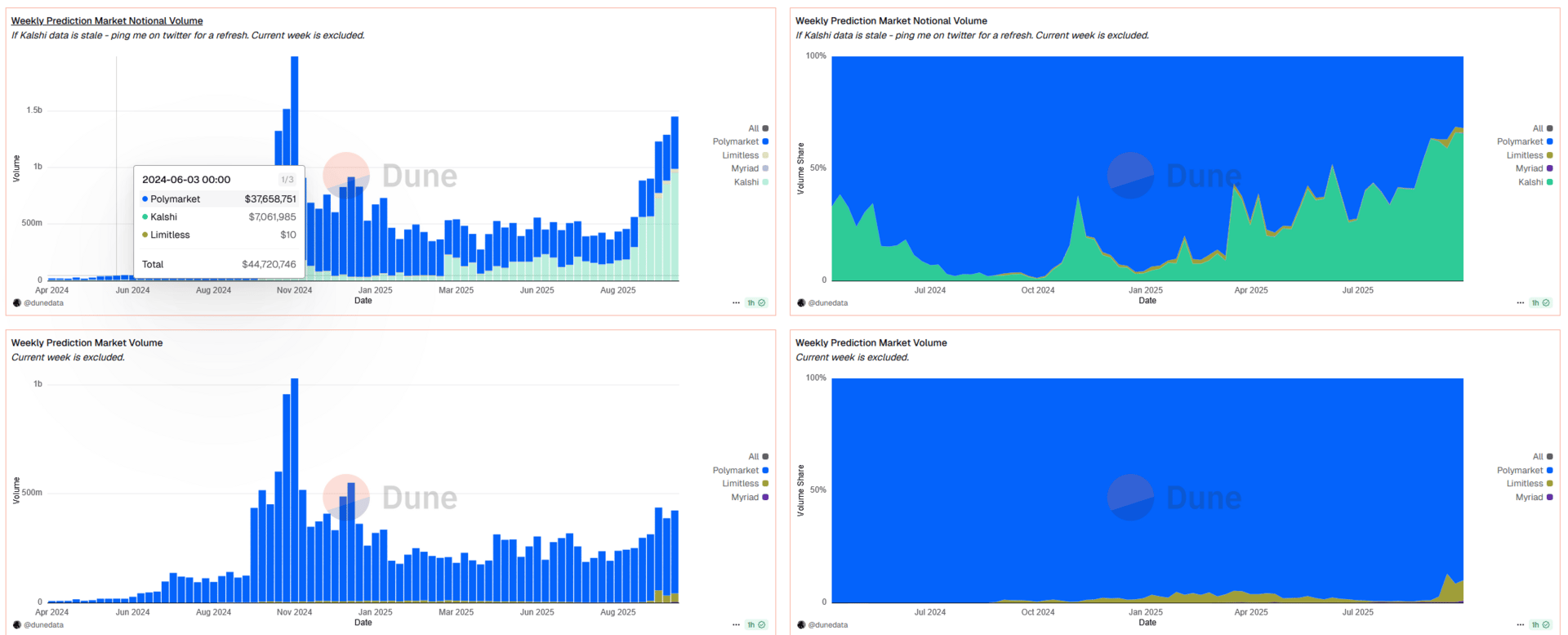

Prediction Markets meta update – activity reaches ATH

The gamblers grew up. What started as a side hustle for crypto degen traders is turning into a data industry, one where odds are the new oracle feeds 🧐

Prediction markets just hit an ATH in both volume and activity, marking their strongest stretch since the 2024 election.

According to DefiLlama and Dune, Polymarket moved $1.43 billion in September, while Kalshi cleared 3.4 million trades, setting records for both volume and transactions 📈

Together they’ve turned “what will happen” into a tradeable primitive 💰️

ICE, the parent of the New York Stock Exchange, just dropped $2 billion into Polymarket. TradFi’s most buttoned up operator now owns a piece of the crypto site that once got grilled by the CFTC. Full circle stuff 🤯

For ICE, it’s not even a play, it’s inventory. Polymarket’s onchain odds are becoming a data product, sold straight to funds and trading desks. The same numbers retail traders use to guess elections will soon feed Bloomberg terminals 🧠

27-year-old Polymarket founder becomes world’s youngest self-made billionaire:

Shane Coplan reached billionaire status after ICE - owner of the NYSE - invested up to $2B, valuing Polymarket at $9B.

A startup once built in a bathroom is now a major player in prediction markets.

— Sabina (@SabinaCreative)

8:16 AM • Oct 10, 2025

In the meantime, Founder Shayne Coplan - 26 years old, became the youngest self made billionaire in crypto.

The guy represents the change that happened to the market perfectly. The kid who built a prediction site out of crypto chaos just turned it into institutional infrastructure 🙃

.. but he funny thing is that the degens got it right first 🥲

The crowd figured out that probability is the market, long before the exchanges caught up. Now, that logic is being industrialized. Every odds market becomes a sentiment feed, every trade a line of data 🤖

UK court jails a degen for turning covid business relief into a crypto bet

It always starts the same way - someone sees the charts, the green candles, the stories about twenty somethings buying Lambos, and decides to “get in” 🟢

During the pandemic, the UK’s “Bounce Back” loans were a lifeline. Small businesses could apply for up to £50,000 to stay afloat. It was meant for payrolls, rent, supplies but with everyone stuck inside, temptation was just a few clicks away 😶

So when a certain small business owner figured out he could get two of those loans instead of one, he took the shot 🙃

Haralambos Ioannou of Cow Lane, Edlesborough, Dunstable, Gets a 22-Month Suspended Prison Sentence and Is Ordered to do 150 Hours of Unpaid Work and Repay £40k for Blagging a Second Bounce Back Loan and Living the High Life with the Money

mrbounceback.com/haralambos-ioa…— MrBounceBack.com (@Bounce_BackLoan)

3:58 PM • Oct 9, 2025

The first went where it should’ve - into a glass fitting company, keeping the lights on. The second became an experiment in “the future of financial freedom”.

Some of it went into crypto. Some of it went to online casinos. Some of it just vanished into withdrawals and personal “expenses.”

The lockdown was a magical time for crypto - DeFi was exploding, Bitcoin doubled, Ethereum quadrupled, and the entire internet looked like one big “get rich or stay poor” challenge. Everyone was a trader. Everyone had a theory. And for a moment, it probably felt like a big move: get dough, ape fast, make it back 1000 fold 💰️

When the dust settled, the business owner was convicted for fraudulently claiming the second loan. The verdict came this week: 22 months in prison, 150 hours of unpaid labor, and a £40,000 restitution order 🤯

It’s a small story - one man’s bad trade - but it reads like a parable from the lockdown era. Governments printed, people borrowed, and a handful decided they were smarter than everyone else. Some bought houses. Some bought heavy bags. Some bought themselves a prison sentence 🤷♂️

Other worthy reads

Macro outlook still bullish, thoughts from Kwaker Oats:

mtf thoughts:

- strong economic data. no signs of slowing.

- govt shutdown tailwind as no eco data to create uncertainty.

- bls comissionner getting replaced with someone trump puts in place is also bullish. they're unlikely to be neutral given what we have seen recently with— Kwaker Oats.usa 🇺🇸 (@kwaker_oats_)

2:22 AM • Oct 8, 2025

“Long live the king” an essay on why 4 year cycle is dead, by Arthur Hayes:

“Long Live the King!” an essay on why the $BTC 4yr cycle is dead.

— Arthur Hayes (@CryptoHayes)

2:59 AM • Oct 9, 2025

Useful tools for prediction markets, according to Decentralised.co:

As Prediction markets cross $1B+ in weekly volumes, teams are launching tools to grab a share of the growing pie.

We can see emergence of early “Photons” and “Bonkbots” of prediction markets, and have compiled them for you to explore.

— Decentralised.Co (@Decentralisedco)

12:02 PM • Oct 6, 2025

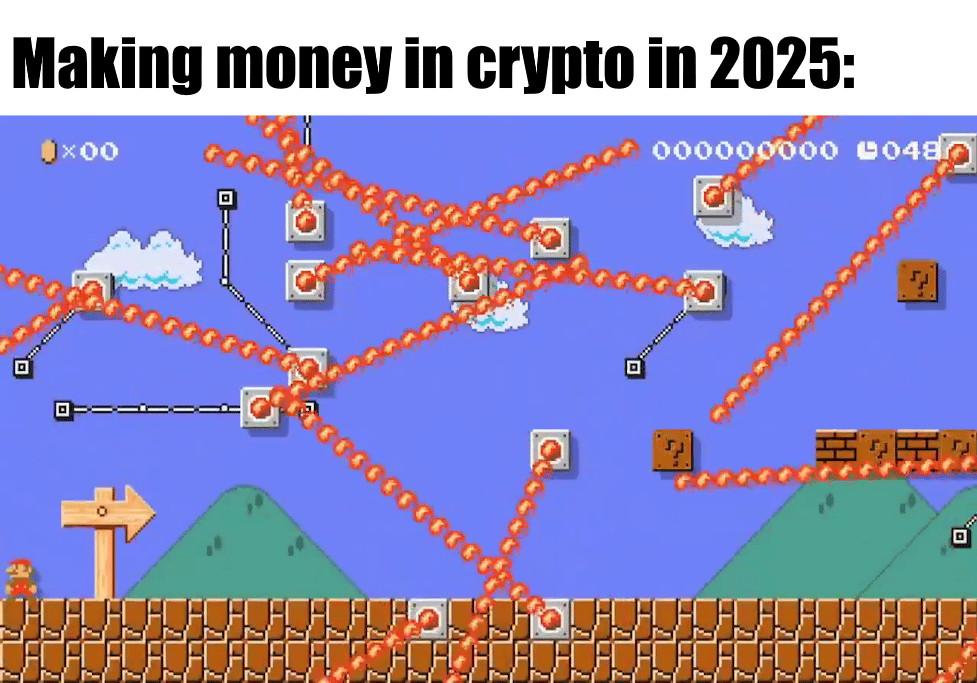

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!