- Web3 on Fire

- Posts

- 🔥 Ethereum’s long game is starting to make sense

🔥 Ethereum’s long game is starting to make sense

Also: a million dollars found in a messy market & about the downside of being "absolutely certain"

GM, frens! ☕️✨

A new year always feels like a reset 🧠

Not because everything suddenly changes, but because the space in front of you opens up again. There’s fewer assumptions, fewer limits and more room to try things that didn’t make sense before. A blank slate.

But big opportunities rarely announce themselves - they usually start as empty space as well 🧙

Today we’re discussing:

🧠 Ethereum’s long game is starting to make sense

💵 A million dollars found in a messy market

🪙 The downside of absolute certainty

👨🦲 Base builders push back as “creator coins” take center stage

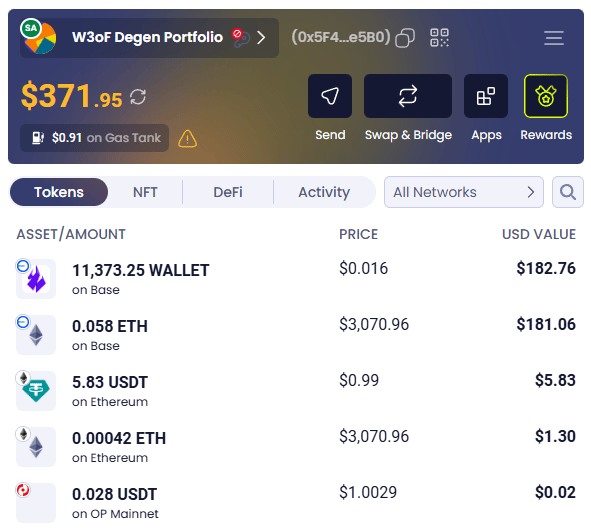

Below is how $WALLET is looking as we kick things off - our starting line for the year ahead.

And if you want to talk through ideas, plans, suggestions or just watch how this blank page gets filled, you know where to find us: the Discord. 🫡

Ethereum’s long game is starting to make sense

Ethereum is closing the year by doing something a lot of people have wanted for a very long time: moving a massive amount of activity, without making users pay through the nose for it 🤯

On December 30, Ethereum mainnet processed roughly 2.2 million transactions in a single day, the highest daily count the network has ever recorded.

That number on its own matters, but the real story sits right next to it. Average transaction fees hovered around 17 cents, a level that used to feel almost mythical during past cycles.

For years, the shared goal across Ethereum was simple to say and hard to deliver: make the chain cheaper while letting it grow. Plenty of people doubted that those two things could move together.

Now it’s clear that they can.

The groundwork for this moment was laid out step by step throughout 2024-2025 👇️

Ethereum went through a steady sequence of upgrades that focused on execution efficiency, validator performance, and higher gas limits without breaking the network under pressure.

Fusaka expanded capacity and improved throughput. Pectra tightened how validators operate and reduced friction that used to stack up when activity picked up. Together they reshaped how the chain behaves at scale 🧠

That work paid off. Transaction volume climbed, yet fees stayed low instead of spiking. The old pattern where heavy usage meant instant pain simply did not show up this time.

What makes this even more important is the kind of activity driving the numbers.

This was not one app flooding the chain for a day.

It was a broad mix of DeFi usage, NFT markets still doing their thing despite everything, L2s settling back to L1 and regular transfers happening in the background. In other words, real onchain usage spread across the ecosystem, instead of some single short lived event ⌚️

This is the version of “Ethereum 2.0” that many people hoped for years ago. A base layer that can handle serious volume, stay affordable, and remain predictable even when things heat up. It does not mean every problem is solved, but it shows that the direction is working 🙃

With 2026 now underway, Ethereum devs are already looking ahead to the next phase of upgrades. Plans like Glamsterdam and later Hegota are meant to keep pushing capacity, reduce costs further, and strengthen censorship resistance 👇️

The roadmap is no longer about proving the chain can survive, but about refining how far it can go.

Ending the year with a transaction record and some of the lowest average fees Ethereum has seen in a long time is more than a nice statistic. It is a signal that the long game is starting to show results 🥇

In the meantime, Vitalik Buterin is doing what he tends to do when the space gets too comfortable: writing essays that cut through the noise without raising his voice.

The point of his latest piece is straightforward 👇️

Power keeps concentrating because scale keeps winning. Coordination is cheaper, institutions lag behind, and systems that claim to be decentralized slowly harden around a small group of decision makers. That’s not a grand conspiracy or anything, but incentives doing their thing.

Vitalik frames this as a balance problem. Technology moves fast, governance moves slow, and without deliberate counterweights, control pools at the top. Decentralization, in his view, is not a slogan or a vibe. It is an engineering constraint 🔧

His answer is diffusion by design

Interoperability that makes exit real, not theoretical. Systems that stay functional even when parts of the network misbehave. Architecture that resists capture by default instead of promising fairness later.

That is also why Ethereum keeps revisiting uncomfortable questions about complexity and influence. If only a few people can meaningfully steer outcomes, decentralization becomes cosmetic. Vitalik is clearly trying to catch that drift early.

He’s not being an alarmist to farm some views.

Decentralization is truly not something you achieve once and move on from. It is something you keep fixing, or it slowly erodes.

A million dollars found in a messy market

The year barely started and crypto already delivered one of those stories that makes people stare at charts a bit longer than usual.

On New Year’s Day, a year old low liquidity meme coin called BROCCOLI714 (named after Binance CZ’s dog) suddenly started behaving in ways that didn’t make much sense 🤔

The price spiked hard, the order book filled with size that didn’t belong there.

One trader claims he walked away with roughly $1 million by reading the mess correctly and acting faster than everyone else 👇️

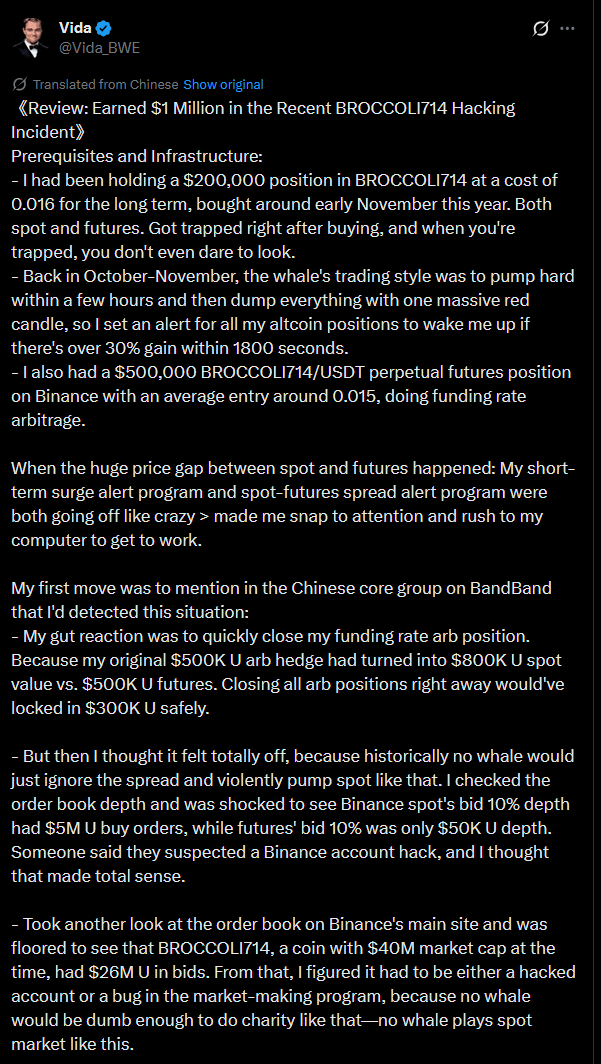

According to logs and posts shared publicly, one trader noticed unusually large spot buys hitting Binance, big enough to drag the price up while futures liquidity lagged behind.

That gap created an opening. He went long into the pump on spot pressure, then flipped short once the move started to fade and futures caught up. Nothing exotic on paper, just timing, leverage, and knowing when something looks like a fake pump 🤪

The trader said his first thought was that something was broken. Either a hacked account or a busted market making tool, because no rational whale throws tens of millions at a thing like that without a plan. Especially not on a busted shitcoin with a tiny market cap 🪙

Binance pushed back on the idea that anything was compromised.

The exchange said internal checks didn’t show signs of a hack or account takeover, and that risk systems were working as intended 🤷♂️

That answer closed one door and opened another 👇️

If there was no hack, then someone with deep pockets or a badly behaving bot was leaning on the spot market hard enough to move price, trigger circuit breakers for traders and temporarily distort futures pricing.

Screenshots showed buy walls close to $26 million sitting just off the price, disappearing and reappearing, then vanishing for good once the trade unwound 🤯

When the buy pressure paused, the price rolled over fast.

The same trader who rode the pump flipped short, covered lower, and claims to have captured the full round trip 💰️

By the time things settled, BROCCOLI714 was trading back near pre pump levels, and the mystery bids were gone.

The downside of absolute certainty

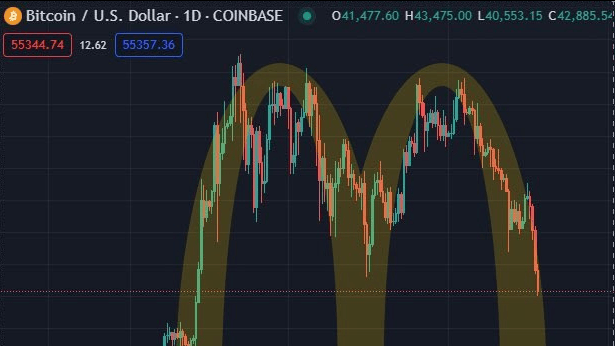

Michael Saylor spent years selling the same idea on repeat. Buy Bitcoin, never sell, volatility does not matter, time fixes everything. It worked great on the way up, especially when the market was willing to treat leverage and conviction as the same thing.

Then the “dumptober” happened 💣️

Bitcoin rolled over and crypto stocks followed. Suddenly, the paper gains that made everyone look like a genius earlier in the year were gone.

According to Bloomberg data, Saylor alone shed billions in net worth over the past year.

Strategy’s stock dropped hard, wiping out months of upside in a matter of weeks.

The Winklevoss twins took a hit too. So did CZ 🤐

None of this came out of nowhere. Strategy’s whole play was leverage, more leverage, and public bravado layered on top. When Bitcoin ran, the trade looked unstoppable. When it stopped, the downside was immediate and brutal. Shareholders paid for it while the narrative stayed unchanged 💸

Saylor, to his credit, did not pretend anything broke.

He stuck to the script. Still bullish. Still long. Still talking about decades instead of quarters. That sounds noble until you remember that real people hold those shares and dumps do not care about philosophy 💀

The point is - the contrast with others in the space is telling.

While the maxis were busy doing nothing except forcing AI to make those annoying laser eyes memes 🤡 other parts of the space moved forward. New ideas came forward, fees came down. Infrastructure got better. Some teams focused on making things usable instead of just talking about moon rockets and forever pumps. No speeches required 🦜

What this episode really shows is how fragile the hero worship side of crypto still is. When prices go up, conviction looks like foresight. When prices go down, the same conviction suddenly looks like stubbornness wrapped in confidence 🤦♂️

The market did not punish innovation here. It punished exposure. Big, public, unapologetic exposure with no plan for when things inevitably flip for the worse.

Base builders push back as “creator coins” take center stage

Over the past year, dozens of teams built apps, tools, and infra on Base, many of them early, many of them without much help, but with the expectation that making real products would eventually be rewarded with visibility and support.

That expectation cracked when Base began aggressively pushing “creator coins” as its headline narrative 😯

Creator coins are tokens tied to individual creators or pieces of content, with most of the activity funneled through Zora and closely related projects.

In recent months, Base’s official messaging, promotion, and social amplification leaned heavily into this model, elevating a small cluster of creator focused launches while largely ignoring the rest of the ecosystem 🤷♂️

The backlash came from builders already on Base.

Several teams that created new projects, driven users, and contributed meaningful activity began pointing out the same pattern.

According to them, if your project sat inside the creator coin narrative, Base noticed you. If it didn’t, you were invisible. No mentions, no retweets, no acknowledgment, even when launches performed well or brought sustained usage to the chain 🛠️

That is where the frustration comes from. Not because creator coins exist, but because Base appears to be picking winners 🤨

Builders are not asking for handouts. They are asking for consistency. A chain that markets itself as open and neutral cannot quietly funnel attention toward a narrow, favored lane while presenting that outcome as organic.

Once promotion becomes selective, incentives distort fast. Teams stop building what users need and start building what marketing accounts will notice 🤓

There is also an uncomfortable contrast here.

Ethereum earned its position by refusing to curate outcomes. It stayed neutral, let builders compete, and allowed entire sectors to emerge without official blessing. Extremely good things came out of this deal, things with potential to revolutionize everything from finances to voting, schools and food chain 🧠

Base inherits that legacy technically, but risks undermining it culturally if visibility becomes conditional.

Base’s transaction counts remain high. The chain is not failing. But ecosystems do not collapse overnight. They start to rust when builders feel sidelined, when effort stops mapping to recognition, and when alternative chains start looking less hostile by comparison 🤥

Other worthy reads

Crypto is entering its practical era - according to Andy:

2026 predictions, by Haseeb:

“Why We're Going Higher in 2026 (the Altitude Thesis)” by Stepan:

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!