- Web3 on Fire

- Posts

- 🔥 When decentralization needs a REBOOT - how AWS outage affected crypto

🔥 When decentralization needs a REBOOT - how AWS outage affected crypto

Plus: What if multichain felt like one account? 🤔

GM, frens! ☕️

Luck gets a bad reputation in crypto. Everyone wants to believe it’s pure skill: the perfect entry, the flawless thesis, the iron conviction. But most of what separates a genius from a ghost account is timing and luck, from what we’ve seen.

Here’s what we’ve been watching this week:

🤦♂️ When decentralization needs a REBOOT - how AWS outage affected crypto

🤔 What if multichain felt like one account?

🤡 Kadena pulls the plug – another “Ethereum Killer” gone

🤵 TradFi’s advisor training now includes crypto

📱 Hardware of the hype cycle: first Solana phone officially obsolete

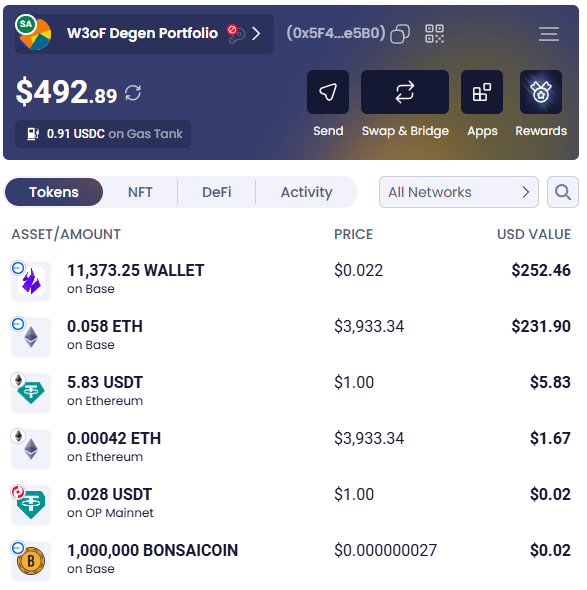

Talking about luck, the W3oF Degen Portfolio played along with fate 👇️

The wheel’s still turning, and as always, we’re keeping our seat at the table.

Come spin it with us in the Discord 🗣️

When decentralization needs a REBOOT - how AWS outage affected crypto

There’s a certain irony to watching “the future of finance” go dark because Amazon sneezed 🙄

For an industry that loves to brag about self sovereignty, one broken cloud server in Virginia was apparently enough to send half of crypto into cardiac arrest 🤒

On October 20th, AWS went down, and with it went Coinbase’s Base chain, MetaMask balances, OpenSea connectivity, and entire layers of the supposedly “decentralized” web. Traders refreshed in panic, dashboards froze, and every shill and KOL suddenly remembered what dependency feels like.

We're aware many users are currently unable to access Coinbase due to an AWS outage.

Our team is working on the issue and we'll provide updates here. All funds are safe.

— Coinbase Support (@CoinbaseSupport)

7:46 AM • Oct 20, 2025

It was déjà vu in the worst way. This isn’t the first time AWS has pulled the plug on crypto’s autonomy - last time a small outage happened in April, but everyone was too worried over crypto prices so it went by mostly unnoticed 💰️

What is the AWS and how does it affect your crypto?

Most people think crypto means “decentralization”

But the truth is almost 90% of the entire crypto industry runs on one company:

Amazon Web Services.

Today the AWS went down.

And with it, so did Coinbase, Binance, Crypto

— StarPlatinum (@StarPlatinumSOL)

10:52 AM • Oct 20, 2025

Infura, the backbone feeding data to Ethereum, Base, Polygon, Optimism, Arbitrum, Linea, and Scroll, buckled as well. When that went dark, everything downstream followed.

Blockchains kept producing blocks, sure, but the gateways, APIs and etc., that people actually use to connect to that backend went offline. The tech survived but the UI didn’t 📵

By the time AWS had “fully mitigated” the issue, Coinbase and Base were still struggling to resync. Users opened their wallets to find zero balances, others couldn’t trade or transfer, and the term “permissionless” started to sound like a bad joke.

The community couldn’t resist twisting the knife 👇️

Governments couldn’t take crypto down for years

It only took few hours for AWS

— Astornia (@TheAstornia)

9:29 AM • Oct 20, 2025

Somewhere along the line, crypto stopped asking itself what it wanted to be. Is it a fast product to sell, or the future of finance? 🤨

Because if it’s the latter, this AWS episode should sting. We can’t talk about trustless decentralized systems while depending on a single company’s uptime. We can’t keep building skyscrapers on rented land and calling it sovereignty 🏰

Crypto was supposed to be the exit, an alternative to fragile, centralized systems. Yet every outage shows how deep the roots of convenience still run.

Maybe the real question isn’t how fast we can scale, but whether most of crypto is still building something worth scaling at all.

The dream of self custody can’t do much if the access point lives inside Bezos’ basement, can it? 🙈

What if multichain felt like one account?

You want to spend 1 ETH. You’ve got 0.5 on Base and 0.5 on Optimism. Today, that means bridges, dust for gas, approvals that stall on the wrong network 🤔

What if all your ETH

Across any chain

Worked as one unified balance.— ambire.eth (@ambire)

10:16 AM • Oct 21, 2025

This idea targets that exact mess: all your ETH acting like one balance - you sign once, the wallet handles the routing, and the payment clears without you juggling chains.

How Ambire gets it closer:

Gas abstraction that actually helps. Pay fees with what you have - stablecoins, tokens - even if the target chain’s native gas is zero. No more “come back later” because you’re out of dust.

Auto routing instead of babysitting. The wallet figures out where funds are, how to settle, and moves value behind the scenes so approvals/swaps don’t die mid-flow 🧠

One view, not seven chores. Balances across networks show up as a single picture, so you manage an account, not a relay race 🎩

The vision is closer than we think

Because the parts are already on the table: 4337 smart accounts are live, paymasters are funding gas with non native tokens, relayers are standard kit.

Add the next wave - cleaner intent routing, safer batching, and broader L2 coverage - and “one pile of ETH” stops being an idea and turns into a default user experience 👨🍳

Kadena pulls the plug: another “Ethereum Killer” gone

“Due to market conditions” the founders said, as they packed their bags and shut off the lights 💡

KADENA PUBLIC ANNOUNCEMENT

We regret to announce that the Kadena organization is no longer able to continue business operations and will be ceasing all business activity and active maintenance of the Kadena blockchain immediately.

We are tremendously grateful to everybody who

— Kadena (@kadena_io)

7:40 PM • Oct 21, 2025

Kadena was supposed to be the professional’s blockchain. Originally.

Born out of Wall Street pedigrees, built by ex-JPMorgan talent, it promised to bring “business grade” efficiency to crypto 📚️

In 2021, it was the talk of the bull market: scalable proof of work, formal verification, hybrid smart contracts, all the buzzwords, but with a Fortune 500 finish.

Then came… the boring.

Transactions were slow, TVL was one of that of some memecoins, partnerships boring and unimportant, community shrank 👎️

The last remaining holders weren’t traders anymore, more like archivists, keeping history alive in some messenger chats 🤓

And now the founders are gone too 🤷♂️

In their farewell note, Kadena’s team thanked supporters and blamed “market conditions” 🤡 for their inability to continue operations. The price went down, and so did the motivation.

🚨 Massive scandal unfolding: Kadena employees caught red-handed shorting their own token $KDA with leverage right before major announcements.

I've seen the proof. Multiple exchanges involved. We're talking tens of millions in profit here.

What happened to integrity in crypto?

— 🕊LOVRIN🕊 (@Lovrincrypto)

6:16 PM • Oct 22, 2025

The chain will technically stay online - miners will keep validating blocks “independently”, like a ship still drifting after the crew has jumped overboard.

The “blockchain for business” died of the most predictable business problem there is - being not profitable and meaningless 🫠

⚠️ KADENA ORGANIZATION SHUTS DOWN: WHAT WE KNOW ⚠️

The @kadena_io ecosystem (including its team and community) are devastated by yesterday's shock announcement.

Countless questions are yet to be answered including:

- What is the reason behind the sudden cessation of

— BSCN (@BSCNews)

11:50 AM • Oct 22, 2025

KDA is MIA

At its peak, $KDA touched a $4 billion valuation. Today, it’s under $40 million - a fat 99 percent dump that looks less like a bear market and more like max extraction and a subsequent run for the exits 🥷

There are still 600 million tokens scheduled to be released as mining rewards until 2139. That’s 114 years of emissions for a project that ran out of breath in less than five 😐️

Kadena shutting down marks the end of an era.

They proved that scalable Proof-of-Work wasn’t impossible, just underappreciated.

A hybrid of Bitcoin-level security and smart contract capability that most of the market never understood.

This isn’t a rug. It’s the reality of

— Dr Joseph Ikhalia ⚡ Real Cyber Doctor (@RealCyberDoctor)

8:27 PM • Oct 21, 2025

The conditions of the market certainly didn’t kill Kadena. It was not the devs either.

It failed because crypto keeps mistaking building for needing a blockchain.

Not every project deserves its own token economy, validator set, and 100 year mining schedule.

Sometimes, the smartest thing to do is to ship less 📦️

TradFi’s advisor training now includes crypto

The hotel ballroom has that end of quarter energy: lukewarm coffee, fluorescent lighting, a projector that everyone is sick of 🕵️

A dozen advisors are cruising through slides on duration and dividend growth when the instructor pauses and asks, “Anyone here ever used a crypto wallet?” 🚬

Half the room looks at their shoes. One guy raises a hand like he’s about to admit his favorite genre is clown music 🖐️

Only then does the badge matter.

The instructor isn’t a conference hustler, he’s from a bluechip asset manager’s digital unit, the kind that moves the market. The logo reads Fidelity Digital Assets - the digital asset arm of Fidelity, the multi trillion dollar firm that staffs huge retirement plans and sets the tone for what “responsible” looks like 🧐

Here’s the big change they brought with them: for financial advisors, digital assets have graduated from risky side plays to core client conversation. Core 🧠

Digital assets are becoming central to advisor-client conversations.

Learn which questions advisors are fielding the most when it comes to this evolving space: go.fidelity.com/hit6xl

— Fidelity Digital Assets (@DigitalAssets)

1:22 PM • Oct 20, 2025

Advisors are being trained to field the same three buckets every time: sizing (how much), selection (which asset or wrapper), and custody (who holds the keys and how) 🧺

The working model is getting standardized. BTC usually comes first because it’s liquid and explainable. Ethereum shows up next where clients can handle staking mechanics and smart-contract exposure.

Everything further out gets treated like frontier markets - sized with respect for liquidity and conviction 🔍️

Beneath the portfolio talk sits the operational grind that actually makes or breaks this stuff. Estate plans with wallet access. Transfer checklists that prevent fat finger tragedies. Rebalance rules that don’t chase candles. A clear memo about who fixes what when something goes wrong ✉️

🇺🇸💰 FIDELITY SAYS CRYPTO HAS NOW BECOME A NORMAL TOPIC IN FINANCIAL ADVISORY

🔸 Fidelity says more and more clients are asking their financial advisors about crypto as the asset class becomes increasingly mainstream and proves its long-term viability.

🔸 The company, which

— ThuanCapitalGlobal (@ThuanGlobal)

7:02 PM • Oct 22, 2025

For advisors, this is actually survival, they’re not surfing trends. Clients are walking in with positions already on, the planner’s job is to turn scattered exposure into a policy. And everyone is going to be holding at least SOME crypto in 2025.

On the other end, products that make advisors look competent - with clean reporting, sane permissions, custody that doesn’t require a personality test - get bought in turn 🫡

This is the paperwork vs firework version of adoption, but in the space such as finance, paperwork always wins.

Hardware for the Hype Cycle: Solana Saga officially obsolete

Solana’s first phone, the Saga, has officially lost official support.

For a product that promised to merge Web3 with real world tech.. Even the cheapest knock off brand phones from Shenzhen can limp along for longer.

But Solana Mobile says it’s time to move on - the Saga is out, and the new Seeker is in 🤦♂️

Solana saga ends support.

— Alex (@ShiLLin_ViLLian)

5:10 PM • Oct 22, 2025

When the Saga launched in 2023, it was pitched as a step into “crypto native mobility” and, to be honest, a sleek nerdy Android with a seed vault and decentralized app store, powered by fast transactions doesn’t sound half bad 🧠

Then came the airdrop hype - users bought phones not for the device, but for the stuff it unlocked. Overnight, a hardware experiment turned into airdrop arbitrage 💵

The Solana Saga has officially reached end of support.

While the new Seeker is still shipping to many customers, this is another coffin in the nail for the OG Solana phone.

The Saga was my entry into the Solana ecosystem and I made $3k with it thanks to exclusive airdrops and

— CryptoParsel (@derparsel)

9:30 AM • Oct 24, 2025

20,000 units were produced in total.

Now, in 2025, the company admits it’s done patching the device. From now on, owners are on their own - unsupported and forgotten 🤷♂️

96 weeks after selling out, the Solana Mobile Saga has reached the end of its support lifecycle

Updates and security patches are no longer provided, and compatibility with software or services cannot be guaranteed

I waited 6% of the time for delivery 💀

— Lost 🎯 (@lostsol404)

6:26 PM • Oct 23, 2025

Compare that to the regular old smartphone industry 👇️

Apple gives seven to ten years of software support. Google does the same. Just to put that in perspective, Apple last pushed a security update on a 10 year old iPhone 6 around the time Solana released Saga 2 years ago 🔽

Even budget Androids from obscure brands - the kind you buy off Temu and find in airport kiosks and such - push out security patches for a couple of years 🙃

In any case, if you think about it, crypto doesn’t need hardware gimmicks. It needs reliability, continuity if you will. The whole premise of crypto, DeFi, web3 is ownership that lasts. Sound money, digital gold, decentralized, that means we should be seeking timeless designs, something a true hodler would throw in his locker and come back to in 20 years.

So when your “decentralized” device turns obsolete faster than some of the shitcoins in the space, the jokes really do write themselves.

‘

Other worthy reads

Trump has just officially pardoned CZ:

Alright, put on your tinfoil hats. I'm connecting dots.

Dot 1: Trump pardons CZ. Political favor? Maybe. Or maybe it's a business introduction.

Dot 2: CZ is now a free agent. The most powerful free agent in crypto history.

Dot 3: $WLFI has been building something suspiciously

— St.Bloodsport (@StBloodSport)

5:36 PM • Oct 23, 2025

“How to start on Polymarket” by wincy.eth

x.com/i/article/1980…

— wincy.eth (@gusik4ever)

1:21 PM • Oct 22, 2025

“State of crypto 2025” report by a16zcrypto:

We’re excited to share our 2025 State of Crypto report.

This year’s story: the maturation of the crypto industry — with growing institutional adoption, the rise of stablecoins, better infrastructure, new consumer experiences, and long-awaited regulatory clarity.

Read the full

— Chris Dixon (@cdixon)

3:00 PM • Oct 22, 2025

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!