- Web3 on Fire

- Posts

- 🔥 “Crypto Week” and how the market almost got NUKED because of it

🔥 “Crypto Week” and how the market almost got NUKED because of it

And in the meantime... memecoins are PRINTING 🤯

GM! ☕️

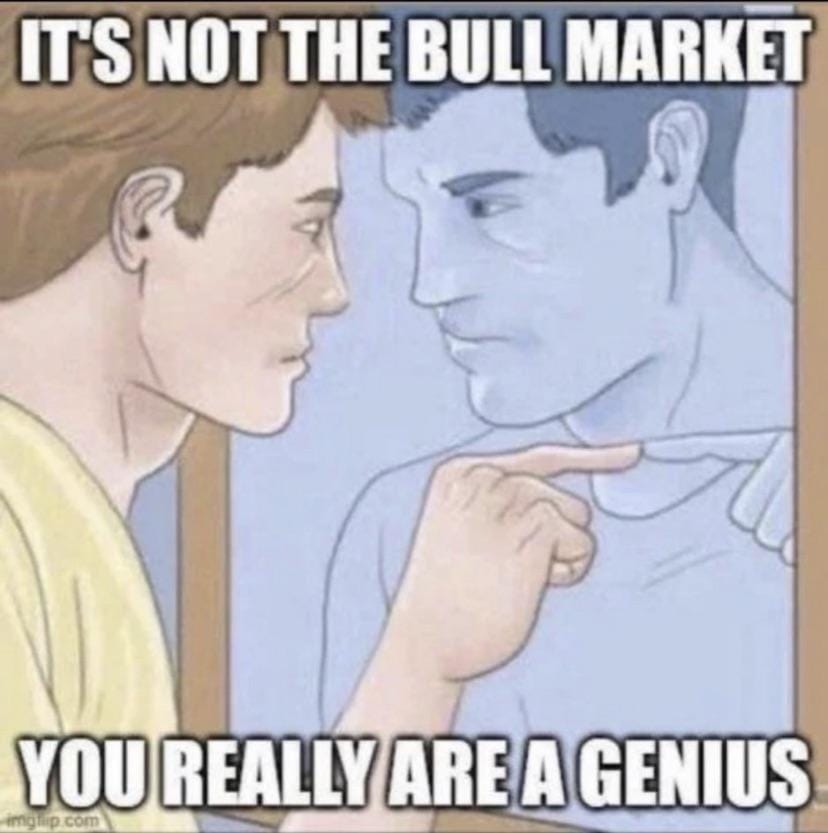

It’s easy to enjoy the green when it shows up - harder to use it as a moment to think clearly 🧠

But these are the weeks that test perspective.

When things feel better, that’s exactly when you ask what comes next.

Here’s what we’ve been watching:

🤡 “Crypto Week” and how the market almost got NUKED because of it

🐸 In the meantime… memecoins are PRINTING

🔥 Ambire: gas without onchain gymnastics

👮 UK Gov agent drains BTC wallets – from inside the vault

🤔 IMF says El Salvador isn’t buying crypto – just moving it around

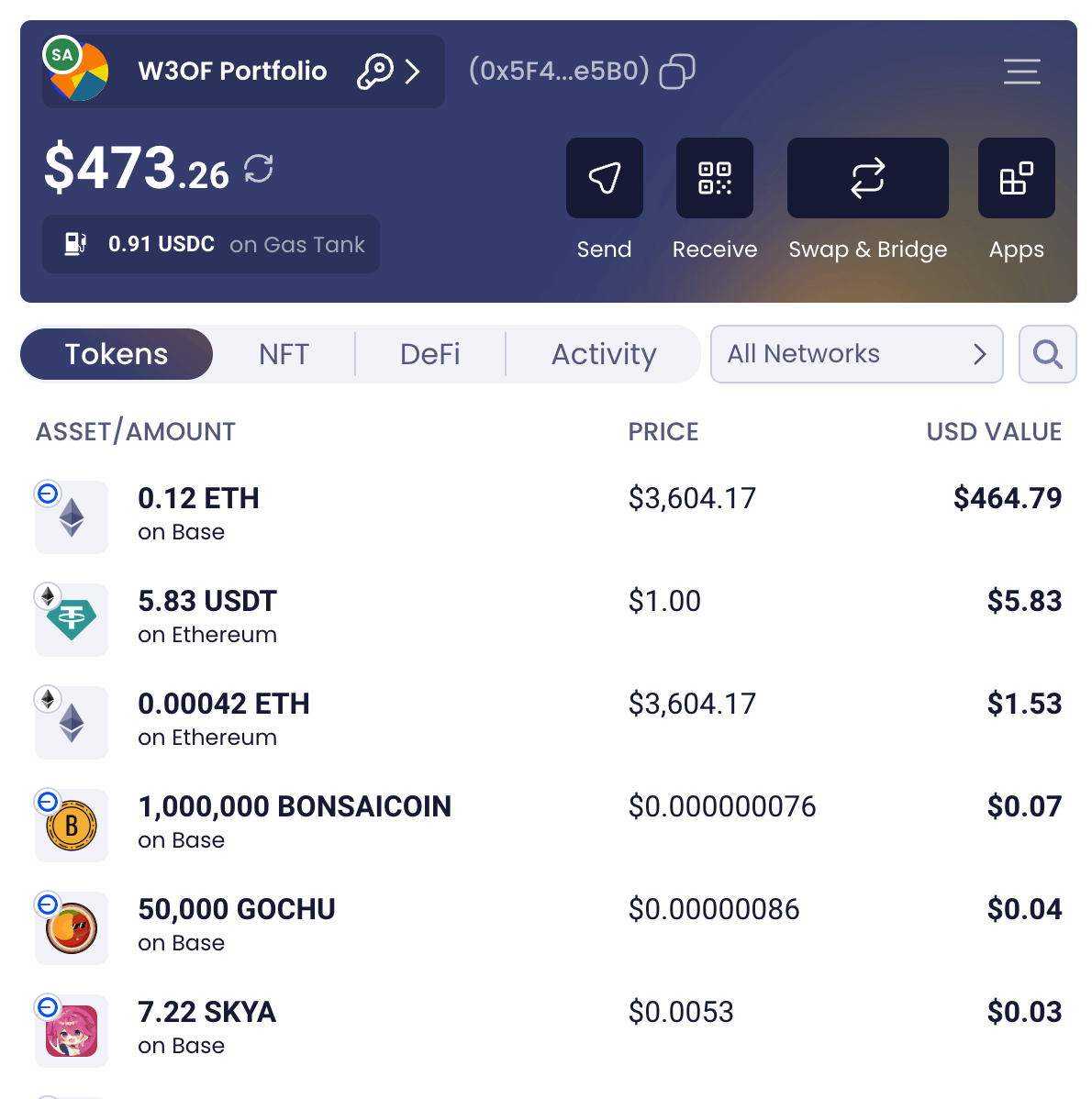

The W3oF Degen Portfolio finally showed signs of life (and we’re not taking credit) 👇️

This one was a full blown ETH miracle, and we were lucky enough to be standing in the right place when it happened 👀

Come break it down with us in the Discord before Vitalik changes his mind 🙃

“Crypto Week” and how the market almost got NUKED because of it

Last week, Washington D.C. rolled out what was unofficially dubbed “Crypto Week” - a planned legislative push to finally get some long awaited crypto regulation off the ground 📜

Several major bills were lined up for House votes. Trump backed & Republican led. Supposed to be “big energy” across the aisle. All in all, looked like the U.S. was about to make a decisive move on crypto.

Instead, everything nearly collapsed - because of bickering inside the party 🤦

JUST IN: US HOUSE DESIGNATES JULY 14-18 AS "CRYPTO WEEK"

— Mario Nawfal’s Roundtable (@RoundtableSpace)

10:16 PM • Jul 3, 2025

A rare Republican standoff

The flagship bill on the table was the GENIUS Act, a “long in the works” proposal to restructure how crypto is regulated in the U.S. It was expected to pass easily. GOP leaders had it queued ⚙️

Trump reportedly made direct calls to House members to lock in support. But then a group of 13 Republicans rebelled - and sided with Democrats to block the whole thing 👎️

Marjorie Taylor Greene led the defectors, criticizing the bill for not going far enough to block CBDCs 🪙

Others in the group raised issues with the Fed’s growing role in crypto regulation, and with how certain exemptions might benefit sitting presidents.

This week, the House is voting on the GENIUS Act which lays the groundwork for a layered Central Bank Digital Currency (CBDC) where Americans interact with stablecoins but behind the scenes there are the functional surveillance capabilities of a CBDC.

The bill as written does

— Rep. Marjorie Taylor Greene🇺🇸 (@RepMTG)

4:37 PM • Jul 15, 2025

And just like that, the momentum tanked 🫢

The elephant in the room: Trump’s own bags

One thing that added fuel to the fire: the Trump connection.

Over the last year, crypto projects linked to Trump and his family have been popping up everywhere - from token launches to rumored partnerships.

So when the act showed up with exemptions that excluded the President but included everyone else in government, it didn’t exactly inspire trust.

Even some Republicans started getting cagey about how the bill might play out 👇️

The so-called “Genius Act” allows Trump to sell access to foreign governments, allows big tech to issue private digital currencies, and devalues the U.S. dollar.

Nothing in this bill prevents a taxpayer bailout when the crypto industry inevitably fails.

Congress must

— Rep. Stephen F. Lynch (@RepStephenLynch)

3:35 PM • Jul 17, 2025

It was supposed to be a clean moment for the industry: three bills, prepped and packaged. Instead, it turned into a flexoff from the MAGA flank who decided that promoting themselves as “CBDCs killers” mattered more than passing the rest of it.

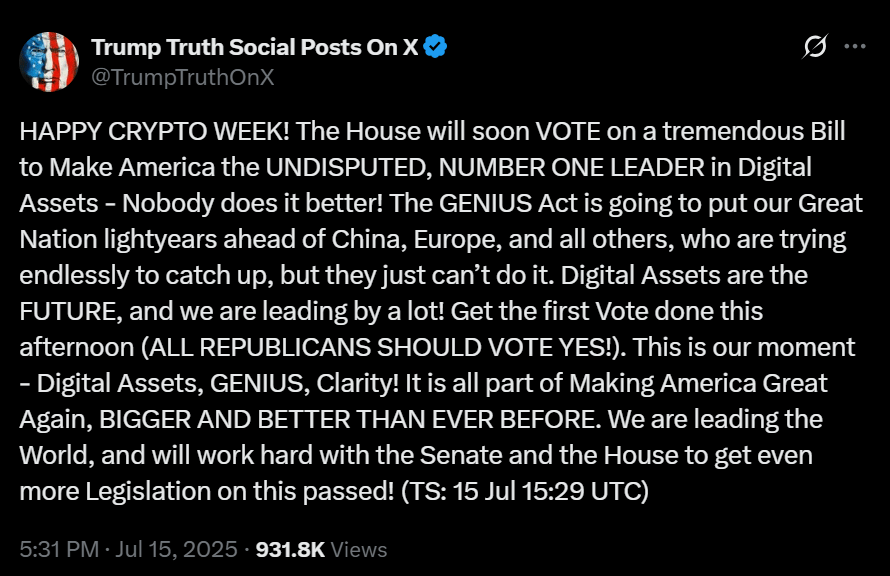

And then Trump himself had to get involved 🍊

As result, by Tuesday night, the vibe in Washington had flipped 🤔

A private meeting in the Oval Office, phone calls from leadership, and a conveniently timed post online claiming the rebels had been convinced to vote the next morning.

A side promise was apparently made: the anti-CBDC clause would be dealt with in a defense bill later this year, instead of being stapled onto the crypto legislation.

🇺🇸 UPDATE: All three crypto bills have passed the House – CLARITY Act (294-134), GENIUS Act (308-122), and Anti-CBDC Act (219-210).

The GENIUS Act now heads to President Trump's desk for signing tomorrow afternoon at the White House.

— Cointelegraph (@Cointelegraph)

11:20 PM • Jul 17, 2025

In the end, the House greenlit the process to bring all three bills to the floor:

the Senate-passed stablecoin framework,

a broader crypto market structure package,

and one targeting IRS guidance on digital assets.

🚨🚨🚨 The House just passed my bill – The GENIUS Act!

This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the U.S. dollar. It will increase demand for U.S. Treasuries.

I look forward to @POTUS signing GENIUS into law –

— Senator Bill Hagerty (@SenatorHagerty)

7:49 PM • Jul 17, 2025

Markets noticed fast.

GM, guys.

BTC.D falling. Total3 pumping. ETH/BTC climbing.

Total crypto market cap just broke $4 trillion.

Meanwhile, the US House is greenlighting #crypto bills: CLARITY, GENIUS, Anti-CBDC.

Feels like that #altseason is knocking 😎

Explosive pumps. Crazy Xs.

Are you ready?— Bebop Crypto (@Bebop_Crypto)

8:07 AM • Jul 18, 2025

Lobbyists had poured millions into flipping lawmakers over the past year (which made many people mad also) and a full collapse during what was branded “Crypto Week” would’ve been brutal 💀

Power corrupts. And in Congress, money buys it. There’s no better display than crypto week, where Bitcoin whales paid off key members to dress their digital pyramid scheme in a cloak of legitimacy, to further exploit the public’s greed and ignorance for their personal gain.

— Peter Schiff (@PeterSchiff)

2:51 PM • Jul 17, 2025

Instead, the hardliners got to declare victory on CBDCs, the bills moved forward, and the crypto industry got to exhale 😌

Still, considering how close the whole thing came to imploding, a few green candles and a roadmap out of the deadlock was more than most were expecting.

Somehow, the crypto market ended the week higher - interestingly enough, not because of what was passed, but because of what didn’t fall apart? 🤔

In the meantime… memecoins are PRINTING

While the politicians were speedrunning legislation and everyone was watching BTC and big alts’ moves, another sector quietly hit escape velocity: memecoins.

The memecoin sector quietly grew ~30% in July, ballooning from $55 billion to $72 billion.

Coins like Floki, Pepe, Bonk, Pudgy Penguins, Doge and SHIB all had a major pump.

Volume pumped across the board, topping $18B in a single day, and even the slower days hovered near $17B 🤯

Just good old fashioned degen pump.

While Ethereum based memes printed, Solana lit a new fire - thanks to a memecoin launchpad called LetsBonk.

Backed by the same Bonk ecosystem that helped kickstart Solana’s meme meta months ago, LetsBonk has exploded in usage. By July 7, it had surpassed Pump.fun in 24H launchpad volume.

💸Revenue: @pumpdotfun vs @bonk_fun

letsBONK.fun's daily revenue has surged by nearly 400% since the beginning of July.

💊 Pump.fun: $4.16M (7d)

🟧 letsBONK.fun: $6.95M (7d)Interestingly, the Pump.fun team began buying

— Drops Bot × FOMO App (@etherdrops_bot)

5:11 PM • Jul 16, 2025

In just one week, LetsBonk racked up $6.95M in protocol revenue, beating Pump.fun’s $4.16M and briefly topping the launchpad leaderboard 🤯

The data showed it clearly: LetsBonk had taken the number one spot in daily earnings, even if Pump.fun still held the edge in liquidity and long term user numbers.

And on Jupiter, LetsBonk was now commanding nearly 2% of all market share, with Pump.fun dropping to under 4%.

24h trading volumes, new wallet activity, and revenue across the board ticked up. Some of it was Solana driven, but Ethereum chipped in too 🪙

ETH itself pushed past $3.5K, up 22% on the week, and that kind of strength usually drags the long tail with it 👀

We’ve seen this movie before

Every time the macro turns quiet and the “serious money” sits on the sidelines, the playground reopens.

The logic is simple: if the adults aren’t moving, the kids will.

So for now, the kids are winning again - trading penguin coins on launchpads with idiotic names while policymakers argue over stablecoin footnotes 🐸

And if the last few cycles are any hint, they’ll keep winning… until someone ruins the fun 🥸

Ambire: gas without onchain gymnastics

For the longest time, using crypto apps meant playing the worst game of Pokémon: trying to catch every chain’s native gas token just to press a damn button 🤦♂️

Need to sign a transaction on Base? Go fish for ETH. Want to bridge out of Optimism? Good luck with that one OP you forgot you needed.

x.com/i/article/1944…

— ambire.eth (@AmbireWallet)

11:10 AM • Jul 16, 2025

Half your wallet is filled with useless dust and the other half is stuck waiting for the bridge to confirm 🤡

Ambire’s Gas Tank is what happens when someone stops tolerating that nonsense ⛽️

You top it up once with any of 100+ tokens - USDC, DAI, APE, doesn't matter - and it just pays your gas on any EVM chain. The end. No more having to go through the whole onramp business through a CEX when you suddenly realize you need $0.21 worth of AVAX.

And unlike some solutions that work only if you’re using their beta version on rainy Tuesday while Mercury is in retrograde, this one just works. Across chains. From your wallet. Without sacrificing privacy or needing to swap into whatever token of the week 🧠

It even tracks how much you saved in fees and refunds you the difference.

Smart transactions are live on 10 chains, @0xPolygon included.

Watch me play around with the latest features 🪄

— ambire.eth (@AmbireWallet)

11:04 AM • Jul 18, 2025

This goes beyond UX - it’s a quiet middle finger goodbye to the entire idea that you need to play token roulette just to use crypto 😉

UK Gov agent drains BTC wallets – from inside the vault

If you ever needed proof that wearing a badge doesn’t mean jack - here it is.

Paul Chowles, a guy entrusted by the British government to guard seized Bitcoin, looked at 97 BTC from a dark web bust and thought “would be a shame if someone… unseized it” 🥷

🚨A cop from Britain’s top law enforcement agency stole £4.4m in Bitcoin.

NCA officer Paul Chowles, from Bristol, was meant to be investigating drug dealer Tom White.

Instead, he helped himself to 50 of White's seized Bitcoin.

This week, Chowles was jailed for 5.5 years. 😬

— Rebecca Tidy (@DrRebeccaTidy)

3:12 PM • Jul 17, 2025

The guy had access because he worked the Silk Road 2.0 investigation. His job was to analyze devices seized from drug kingpins 📱

But his actual work amounted to use that access to funnel over 50 BTC to himself, cover the tracks with a mixer, and liquidate through debit cards 🧐

From 2017 to 2022, he stole over 50 BTC. That’s five years of bleeding the agency’s crypto stash dry - quietly, methodically, with the kind of confidence you only get when nobody’s watching the watchers.

And make no mistake - nobody was.

When funds started going missing, the NCA assumed the bad guys somehow remotely drained their own evidence wallets. They seriously believed the criminals they locked up had reached through the void and pulled BTC from their prison cell.

That’s how long it took them to even consider that their own guy might be dirty.

When they finally did, they found the kind of sloppiness that would embarrass even the most idiotic scammer 🤦♂️

Chowles had written down wallet passwords and stored them at home. His phone was tied to the laundering wallets.

He used Bitcoin Fog, a mixer so burned it might as well be an Interpol honeypot. And he cashed out with crypto debit cards with his name attached.

He even paid his own credit card debt with the stolen funds.

So not like Ocean’s Eleven, more like a crypto related Mr. Bean episode 🤪

Eventually, he confessed. Pleaded guilty. Got 5.5 years in prison - a slap on the wrist compared to the time some Silk Road users got, even for buying weed 🙄

Of the 97 BTC that was meant to be in evidence, only 26 remain. The rest - poof, washed, spent, probably lurking in some long dead Binance account or melted into meme coin rugs back in 2021. Good luck tracing that.

Oh and it always plays the same in old media: when government steals, it’s a lesson in forgiveness. When crypto somehow breaks, it’s a headline about how “the technology failed again” and “crypto was always a scam” isn’t it 👴

IMF says El Salvador isn’t buying crypto – just moving it around

That’s the new line from the International Monetary Fund, which now claims El Salvador’s rising Bitcoin reserves aren’t from fresh buys, but simply “consolidation” of existing wallets.

The report confused the space when it landed 🤔

Apparently, all those daily BTC purchases President Bukele tweeted about? Just wallet hygiene. No new exposure. Nothing to see here.

Either the IMF is lying about #bitcoin.

... or ...

El Salvador is lying about #bitcoin.— ARNOLD HUBACH ⚡️ (@st4rnold)

12:30 PM • Jul 17, 2025

Of course, that interpretation neatly aligns with the IMF’s long standing discomfort with the entire experiment 👇️

Since 2021, they’ve warned, pressured, and outright threatened El Salvador over its Bitcoin policies - even dangling $1.4 billion in loans as leverage. Now, conveniently, they’re here to reassure everyone that actually, nothing rebellious is happening after all 🤷♂️

But here’s the part that gets weird: onchain data doesn’t lie. The government’s holdings are up somehow - over 6,200 BTC, now valued at more than $760 million. Every month, 30 more coins appeared in the treasury. Someone is pushing buttons 🪙

EL SALVADOR JUST BOUGHT MORE BITCOIN

— The Bitcoin Office (@bitcoinofficesv)

10:03 PM • Jul 17, 2025

So either Bukele’s team is sneakily stacking while claiming it’s all routine balance transfers... or the IMF is doing what it always does – spinning the story to regain control of the narrative. Pick your villain 🤕

The report also trots out praise for El Salvador’s “progress”: stricter reporting, better transparency, and eventual privatization of the Chivo wallet app 📱

All good things, in theory – except when they’re pushed by an institution whose track record is less about transparency and more about conditionality. When the IMF says “improving governance” it often translates to: we’re back behind the wheel 🫲

What’s really at stake isn’t whether El Salvador is buying one coin a day or just moving their bags from cold to hot storage 🙃

It’s the optics.

Crypto used right, in the hands of a sovereign government, especially one outside Bretton Woods - still sends shivers down their spines.

The IMF’s worst-case scenario? That El Salvador’s experiment actually works. That crypto becomes a credible reserve asset. That other nations, watching quietly from the sidelines, start wondering why they need middlemen with interest rates, endless red tape and fine print when they could just hold keys 🧠

So, are the coins just being shuffled? Maybe. But don’t expect the IMF to ever admit if they’re wrong - just expect them to tighten the leash when they can.

Other worthy reads

Coinbase stonk apparently did a 60% in the past month:

What a monster month for COIN stock 📈

Up 60% to $410 and a smashing new ATH

— TylerD 🧙♂️ (@Tyler_Did_It)

2:13 PM • Jul 17, 2025

The new strategic reserve meta working out real well for $ETH:

NOW: BitMine Immersion now holds $1b in ETH

Seven days after a $250m private placement, BMNR's ETH holdings total over 300,000 ETH.

Bitmine Immersion wants 5% of the total ETH supply.

— Dynamo DeFi (@DynamoDeFi)

2:47 PM • Jul 17, 2025

“The Myth of the Billion-Dollar Idea” article by Chilla:

x.com/i/article/1945…

— Chilla (@chilla_ct)

4:06 PM • Jul 16, 2025

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!