- Web3 on Fire

- Posts

- 🎄 Crypto in 2025, what changed and where we’re headed

🎄 Crypto in 2025, what changed and where we’re headed

Overview of 2025 in crypto

GM, frens! ☕️🎄

Merry Christmas. Happy Holidays, if you prefer. And a Happy New Year, obviously! 🍾 🥂

If you still have a problem with that - Santa’s already locked the allocation, and it’s 100% coal with no vesting schedule 🪨

Jokes aside, making it through another year in this space is no small thing.

Wins, losses, chaos, late nights, bad calls, good instincts - whatever happened - you’re still here. But a new chapter’s loading, with fresh chances and hopefully fewer self inflicted wounds ❄️

Let’s make the next one count 🥳

Today we’re discussing:

🎄 Crypto in 2025, what changed and where we’re headed

🤦♂️ A New Year’s present from the FTX case that nobody really wanted

🥷 Trust Wallet’s extension gets hacked

🪙 Blockchain gaming vs the “post easy money” era

🛠️ Ambire’s 2025 wasn’t TALK, it was WORK

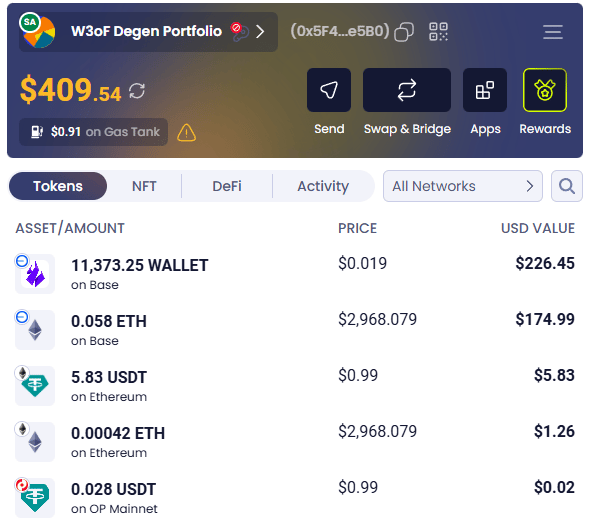

Below, here’s how $WALLET is doing:

And as always, the conversation rolls on in the Discord - drop in whenever 🎅

🎄 Crypto in 2025, what changed and where we’re headed

2025 felt like the year crypto actually had to deliver.

Prices ran insanely hard early on, to levels people only could dream of previously. The pump has cooled off later, but somehow the space kept moving strong 💪

Total market cap pushed past $4 trillion at the peak, Bitcoin ran past $126K, and ETH, SOL, and even XRP all printed fresh highs along the way.

What made this year different was not just how far prices went. It was what happened after it all ended: usage and conviction did not fall off a cliff.

People kept using apps, stablecoins kept moving around, devs kept building even when the charts stopped being fun to stare at. That alone separated 2025 from the usual hardcore spiral dominoes we’ve seen in previous cycles 🫠

Big players finally stopped watching from the sidelines and stepped in properly 👇️

The US setting up a Strategic Reserve was a signal that crypto is now treated as something you manage long term, not a fad that you wait to blow over.

+ Spot BTC and ETH ETFs went live and started soaking up supply, with ETH ETFs alone holding around five percent of circulating ETH by mid year.

By the end of 2025, crypto felt less like stuff for nerds and more like infrastructure people cared about 💵

DeFi was back

DeFi did not just come back in 2025, it came back a bit wiser. Lending picked up fast, with total active loans pushing past $45 billion at the peak 😲

Aave doubled its loan book over the year, and newer protocols like Morpho found real traction.

Onchain derivatives also exploded. Hyperliquid showed that onchain perps can compete with centralized platforms when execution is good and costs are low 💰️

For a while it controlled most of the decentralized perps market before competition stepped in and ate into that share. Total decentralized perps volume broke $1 trillion during the hottest months before cooling later in the year.

The biggest change came from real world assets. Tokenized Treasuries, stocks, gold, and similar products went from being talked about to actually having size.

Onchain Treasuries crossed $8 billion, tokenized equities volumes jumped, and platforms like Ondo, Backed, Dinari, and Securitize became big names 🔒️

Regulators did not shut this down either. In some cases they leaned in, running sandboxes and allowing experiments to happen in public.

Prediction markets became the biggest boom of this cycle:

Polymarket and Kalshi pulled in more users, especially around elections and major events, and started being treated as useful signal instead of a novelty 👀

A strong year for Ethereum

A lot of that came down to upgrades finally paying off in ways normal users could actually feel. Building on earlier changes, Ethereum rolled out the Pectra and Fusaka upgrades, while the Dencun work from late 2024 started showing real results this year.

Blob transactions landed, Layer 2 fees dropped hard, and rollups became cheap enough that most people stopped thinking about fees entirely 🗯️

Mainnet fees averaged well under a dollar for long stretches, and most activity moved to L2s where costs were close to nothing.

By midyear, more than half of Ethereum transactions were happening off mainnet through rollups like Arbitrum, Optimism, Base, and StarkNet ⛓️

That had real effects.

Apps became faster and DeFi became usable again for regular users who are not moving mountains with every transaction ⛽️

Staking kept growing as well 🥩

Nearly thirty percent of all ETH ended up staked by the end of the year, with yields sitting around four percent.

Some public companies even started treating ETH staking as a treasury plan 💲

Ethereum has shrug off tons of FUD that was plaguing it at the beginning of the year, devs’ hard work started paying off 🫡

The market tested everyone’s conviction

BTC pushed to fresh highs in October, ETH followed, altcoins (sort of) joined the run, and social feeds filled with targets that aged badly within weeks 😐️

Then Q4 arrived. And with it, macro pressure, politics and profit taking / leverage unwinding dragged prices down across the board 💸

BTC slid back into the high five figures, ETH dropped lower, and a lot of late cycle optimism evaporated fast.

What mattered was what DID NOT happen → users did not disappear. DeFi did not freeze. Stablecoins did not drain. ETFs did not collapse. Exchanges didn’t explode. The market cooled without breaking, which says more than another straight line megapump ever could 🥳

Large funds kept buying in the background, ETFs kept holding supply, and serious builders kept working. Short term traders took a hit, but the difference between fast money and long term conviction became clearer than ever 🧠

Laws (kinda) stopped being pure chaos

Regulation in 2025 still annoyed everyone, but it stopped being a constant jump scare.

Europe rolled MiCA into effect, and while it was not flawless, it gave crypto companies a rulebook instead of guesswork.

In the US, the tone changed fast. A new administration leaned in instead of treating the space like an enemy by default 🤝

The GENIUS Act brought stablecoin rules into US federal law. The CLARITY Act moved forward even if it did not fully land yet.

Agencies pulled back from lawsuit driven policy and started talking about frameworks instead. Banks were allowed back into the room. Custody, trading, and token issuance moved forward under supervision instead of fear 🙃

None of this solved every problem, and DeFi rules are still up in the air, but the direction was obvious. Crypto is being regulated because it’s now a part of life.

The Achilles heel of the industry

Security was the ugly counterweight to all this progress 🤦♂️

Hack totals hit around $2.7 billion in 2025, with the Bybit breach alone accounting for roughly half of that.

Smaller attacks hit DeFi protocols, exchanges, and bridges throughout the year, and North Korean groups remained disturbingly effective.

The response improved but the problem stayed the same 💀

Centralized choke points still fail hard when they break, and smart contracts still demand obsessive review.

Recovery efforts improved, coordination improved, but prevention remains the real challenge heading into 2026 🤷♂️

What 2026 looks like from here

Heading into 2026, this does not feel like a year for hype.

It feels like a year for scaling what works. The upgrades will continue, L2s will carry even more load, and DeFi will likely keep growing where products actually make sense instead of chasing hype.

The wild days of crazy senseless pumps are over, and everyone understands this now. Only real utility will survive 🤠

Big money is not backing away.

Tokenized assets are likely to expand further. ETFs may absorb even more supply. Compliance will tighten, not loosen, and that will probably unlock more capital rather than scare it off 🪙

There are risks, too.

Legal fights around DeFi could flare up - the serious debate about decentralization vs security is still ahead of us 🤐

Macro conditions could flip sentiment quickly. Security incidents are not going away. But after 2025, the space looks MUCH better equipped to absorb shocks without falling apart 😌

So yeah crypto did not become perfect this year. But it became… real. And that might be the most important milestone of all.

A New Year’s present from the FTX case that nobody really wanted

Crypto is getting a New Year’s present, and it’s the kind nobody asked for.

One of the most scummy and widely disliked figures the space has ever produced is set to walk free far sooner than most people expected 👇️

Caroline Ellison ran Alameda Research, the trading firm tightly wired into FTX, the exchange whose collapse triggered one of the largest blowups the crypto market has ever seen and wiped out billions in user funds almost overnight 💰️

She is now set to get out on January 21, 2026. That date comes from updated public prison records.

Ellison wasn’t the face of FTX, but she was deep inside the operation. She had access to the books, understood how funds were being moved, and sat close enough to the core that when everything fell apart, she knew exactly what had happened.

When the collapse hit, she didn’t try to stall or drag things out. She flipped early and handed prosecutors internal details that became central to the case against Sam Bankman Fried.

That cooperation mattered, and it paid off.

On paper, Ellison received a two year sentence. In reality, she barely served it 🤷♂️

Earlier in 2025, she was already moved out of prison and into supervised housing, which is basically the long walk toward the exit.

From there it turns into check ins, restrictions, and waiting out the calendar. January is when the door actually opens 🔓️

The deal was not free. Ellison agreed to stay out of officer and director roles for ten years and is barred from running anything tied to public companies or crypto exchanges. She will remain under supervision after release and is locked out of regulated finance 🙄

Still, the comparison is hard to ignore.

FTX wrecked lives, destroyed trust, and handed regulators their favorite example forever. Bankman Fried is serving a 25 year sentence. Ellison, who was inside the operation while it ran, is walking after a short bid because she cooperated early and helped close the case 🤦♂️

It’s understandable that this isn’t about rewriting the story but rather about incentives. In cases this big, information becomes leverage. Ellison had it, traded it, and shaved her time down hard.

But the fallout isn’t even truly over.

FTX still gets dragged into every conversation about oversight and enforcement. It’s the example that keeps coming back whenever new rules get pushed or old ones get tightened. Markets moved on, new cycles showed up, but that collapse still shapes how the space is treated 😶

So we don’t get any redemption here. We just get reminded how the system treats people help the state win.

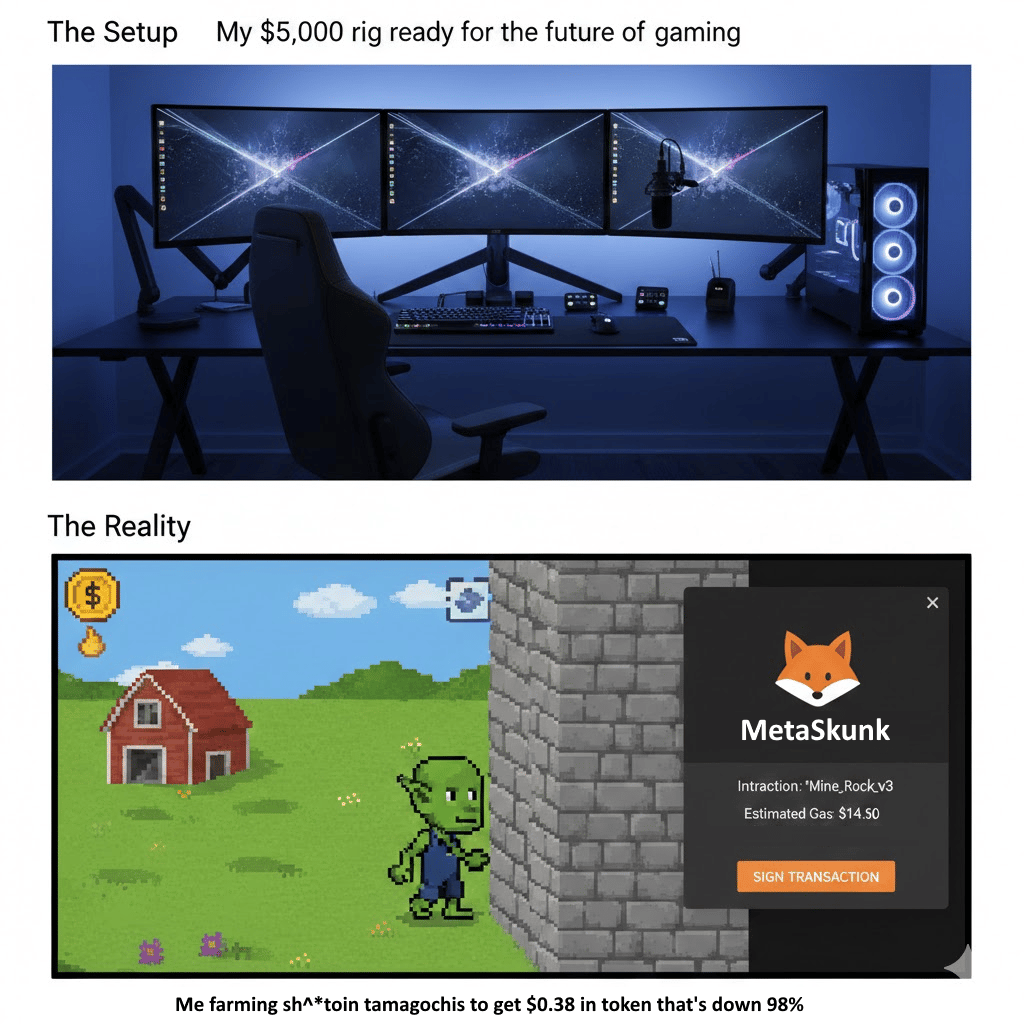

Blockchain gaming vs the “post Easy Money” era

The Blockchain Game Alliance released its yearly State of the Industry report, and it lands at a pretty specific moment for blockchain gaming.

According to the BGA, the space is smaller than it used to be, money is harder to get, and nobody is pretending that throwing a token at a game automatically makes it work anymore 🧠

A lot of studios didn’t make it through 2025 👇️

Teams shrank, and funding dropped far below the levels seen during the peak years. The teams still operating are the ones that adjusted quickly or never built their entire plan around speculation in the first place.

Token launches are no longer the main event.

In many cases, they are not even part of the plan. According to the report, devs talk far more about launch quality, retention, and whether a game can keep players around without dangling financial incentives every week.

Deploying a playable, stable game comes up again and again as the top focus, with revenue models following closely behind. That alone says a lot about how much the mindset has changed 🤔

Funding gets addressed in a very direct way. Capital is still out there, but it’s cautious and selective.

Investors want proof that something works before committing, not promises about future ecosystems. Several teams admit that tighter funding forced them to simplify what they were building 🛠️

According to the report, that pressure often led to better decisions, even if it wasn’t comfortable at the time 🤓

When it comes to monetization, instead of complex token systems, teams are now leaning into things players already understand 🪙

Cosmetic items, optional upgrades, and familiar progression systems show up far more often than aggressive financial DeFi mechanics.

The infrastructure discussion follows the same logic.

Devs talk about hiding complexity wherever possible. Wallets, networks, and transactions are treated as background details rather than selling points.

The report reflects a growing belief that if players constantly have to think about blockchain mechanics, something is already wrong. Games that perform well tend to make the tech almost invisible 🫥

Geographically, development is happening across many regions, with no single center dominating everything 🌍️

That brings challenges, from regulation to funding access, but teams seem more comfortable navigating those differences than they were in earlier cycles.

One of the more interesting threads running through is how expectations have changed internally.

Devs are no longer trying to build massive platforms from day one. Many describe their current projects as focused experiments. So it’s like you launch something contained, see how players respond, then decide what comes next. Which is good thinking - it’s slower, but it leaves room to adjust instead of collapsing under its own weight 🧱

The picture the report paints is very clear. Blockchain gaming in 2025 isn’t completely dead, but it isn’t booming either.

The real question now is whether it can keep running steadily, year after year, without constantly needing a new narrative to survive. According to the devs and experts, that’s the phase the industry has entered. Let’s see how it goes for these guys 🫡

Trust Wallet’s extension gets hacked

With the year almost over, crypto managed to squeeze in one last headache, and it didn’t come from markets:

This time troubles landed on Trust Wallet ☠️

Users started reporting that their BTC, ETH, and BNB vanished shortly after a Chrome extension update. In multiple cases, balances dropped fast and without warning, with funds moving straight into a small set of wallets 🤯

Onchain data showed more than $4.3 million leaving user accounts through the same transfer patterns. Several users said the losses happened right after importing seed phrases into the updated extension 🥷

Security researchers flagged multiple receiving wallets tied to the drains, all behaving the same way across chains. Meanwhile, users were left waiting 🥴

And these weren’t edge casers doing risky experiments either.

These were people doing usual wallet things - installing updates, importing keys, etc and expecting basic safety. When that ends with empty balances - well, no excuses hold up here anymore 🤦♂️

So for some crypto still wraps up the year with a familiar tragedy.

Well , we all know self custody only works when the tools respect how fragile that trust really is 😐️

Ambire’s 2025 wasn’t TALK, it was WORK

Talking about PROPER TOOLS, Ambire spent this year doing the unglamorous dirty work that actually makes a wallet usable 🔨

Most of the updates hit the spots that matter 👇️

Phishing protection was tightened so bad links and sketchy apps get flagged before you click yourself into a mess 🥷

Token transfer checks now step in when something looks off, especially when you send to a fresh address, which is exactly when people usually get burned.

The app catalog got cleaned up too. Apps are easier to find, easier to verify, and you can actually see what you’re connecting to instead of guessing.

ENS avatars finally show up properly, which sounds cosmetic until you realize how better it is to recognize who you’re dealing with 😎

Auto login removed a pile of pointless signing prompts, making daily use less annoying, and Gas Tank top ups landed so paying gas across chains doesn’t turn into a mini side quest every time.

So, well, yeah it’s not something out of this world.

It’s a year of meticulous dev work focused on fewer mistakes and removing friction. Which is kind of the point when you’re talking about tools people trust with their money 🫡

BTW, Rewards Season 2 is already LIVE, with rewards scaling alongside real usage 👀

The more swap and bridge volume that runs through Ambire during the season, the bigger the incentive pool in $WALLET that gets unlocked.

Get more info down here 👇️

Other worthy reads

Some info on the ongoing AAVE governance drama:

The Research Paradox in Prediction Markets, by Polyfactual:

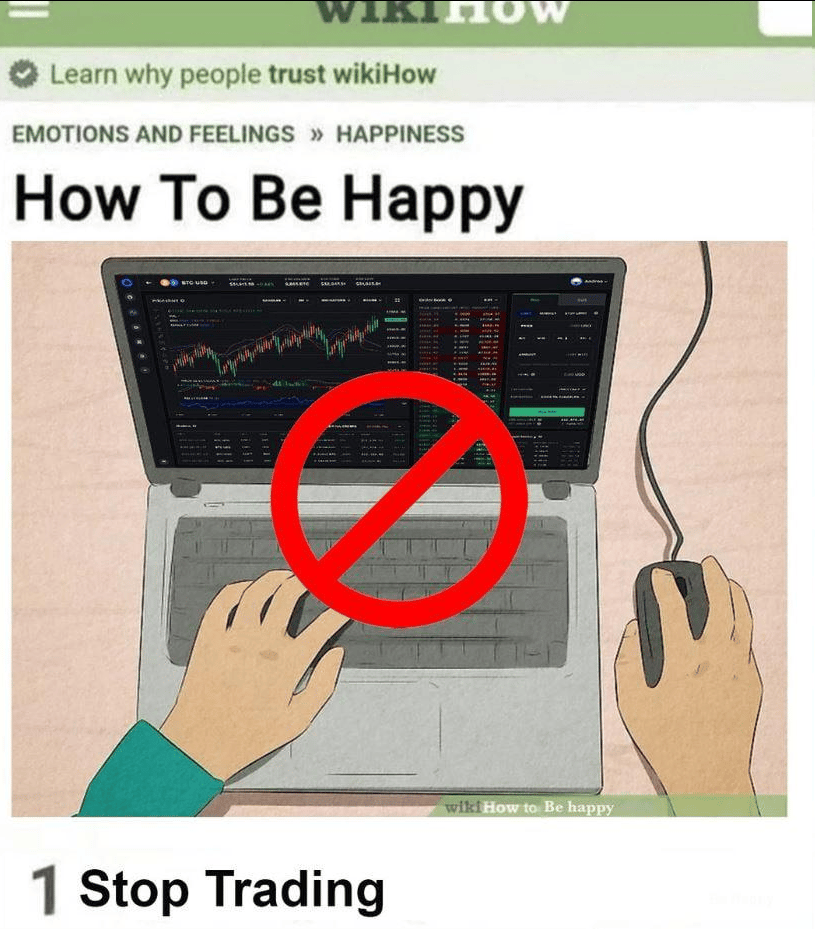

MEMES

That's all for now, frens.

We'll meet in the new year! After the lights dim, the wrapping paper’s gone, and the calendar flips.

Markets will do what they always do, moods will change, narratives will reset. That part’s seasonal. What isn’t seasonal is honest work.

Building and pushing Web3 forward doesn’t take holidays - even if we do pause to recharge. Thanks for spending part of your year with us. We’ll be right back, refreshed, focused, and ready for whatever the next year brings.

Until then, enjoy the break, keep your head clear, and don’t let the candles fool you. Cheers, and Happy New Year 🥂

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need