- Web3 on Fire

- Posts

- 🎅 When crypto becomes a legitimate Christmas gift

🎅 When crypto becomes a legitimate Christmas gift

🔥 Ambire Rewards Season 2 is now LIVE - more practical & fair

GM, frens! ☕️

Everything ends. Not as “punishment” or a failure.. just as a rule of nature.

Cycles close so new ones can start, trends fade so better ideas can take their place. In crypto especially, nothing is meant to last forever, and that’s exactly why it keeps renewing itself 🙃

But here’s what we’re discussing this week:

🎁 When crypto becomes a legitimate Christmas gift

🔥 Ambire Rewards Season 2: getting more practical

💵 Marshall Island’s blockchain UBI experiment

💊 The dev that wanted to DESTROY Pumpfun gets 6 years in prison

🤪 US kicks crypto rules down the road, again

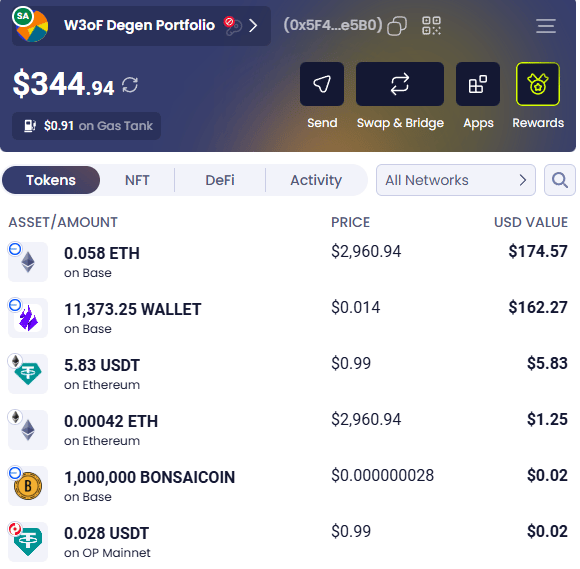

Here’s how our $WALLET bag is doing 👀 👇️

You know where to find the ongoing discussion: our Discord 🤠

When crypto becomes a legitimate Christmas gift

Crypto didn’t sneak onto the holiday shopping list. It walked in, sat down, and took a number 🎅

According to a survey by the National Cryptocurrency Association, roughly one in four people in US now say they’ve either gifted crypto already or are seriously considering it this season 🤯

That alone tells you how far things have changed.

Five years ago this would’ve sounded like bait to farm likes under some shitpost on twitter. Today it’s real consumer behavior 🛒

What’s interesting isn’t that people are buying crypto as gifts. It’s why 👇️

A growing chunk of respondents say they’d rather receive crypto than a traditional gift card. Not because they’re moon boys of some sort, but because gift cards famously die slowly deaths in drawers.

Crypto, on the other hand, stays alive. And increases in value. It can be held, moved, split, or ignored without expiring into corporate breakage revenue 🪙

There’s also practicality creeping in:

People associate crypto with flexibility and optionality. You don’t have to spend it immediately. In fact, you don’t have to spend it at all. And yes, some still like the idea that it might be worth more later. That part never really goes away. But it’s no longer the whole principle 🧠

The behavior compounds once you look at existing users. Among people who already use crypto, a clear majority plan to pay with it during the holidays, and about half expect to receive it as well 🎄

Demographics matter too, but not in the way the stereotypes suggest.

Younger users lead gifting activity, but ownership cuts across income, profession, and age 👴

Older cohorts aren’t absent, there’s just less of them. But crypto holders aren’t clustered in finance jobs or high income brackets anymore.

The bigger signal is psychological.

Crypto is being shown less as an investment object and more as a usable commodity 💰️

A form of value that doesn’t need a justification speech attached. Something you can give someone without having to explain why it exists.

When people start wrapping it up for the holidays, the argument phase is already over. Crypto has won 🎁

Ambire Rewards Season 2: getting more practical

Ambire Wallet runs Ambire Rewards - a loyalty programme which is a mechanism for fair distribution of the Ambire Wallet governance token $WALLET.

Ambire has now moved Rewards into a season 2 electric boogaloo - this time with a clearer internal logic and fewer unnecessary moving parts 😎

The first 2 seasons (pilot Season 0 and Season 1) confirmed that users were willing to interact with the wallet in meaningful ways, from swaps and bridges to staking and governance, and that this activity could be measured without relying on superficial incentives.

Season 2 builds directly on that observation 👀

Instead of gamification, XP or abstract progression, the system now relies on a score derived from measurable wallet behavior 🏋️

Average balance, liquidity, staked $WALLET, swap and bridge volume, governance weight, and consistent transaction activity all contribute to the final result.

The model is linear, which removes the advantage of spreading funds across multiple wallets and favors fair sustained participation instead 🤝

The focus on “fair” is big this time

The reward pool also works differently now 👇️

It grows only if overall swap and bridge volume inside Ambire grows. If usage stays low, the pool stays smaller and the season can run longer 🔒️

If activity picks up, the pool expands. Everyone is pushing toward the same milestones, and everyone benefits when they are reached.

Rewards are no longer split across different programs either. Everything runs through Ambire Rewards now, with staking and governance still counting, but not overpowering everything else.

The idea is to reward people who actually stick around and use the wallet in a meaningful way, not those farming a quick buck 🤷♂️

All of this now lives directly inside the Ambire extension. You can see your score, what affects it, and how close the community is to the next threshold without leaving the wallet.

Season 2 does not try to sell a new vision or reinvent incentives. It trims the excess stuff and lets rewards follow real usage instead of tricks 🫡

Marshall Island’s blockchain UBI experiment

Universal basic income usually lives in white papers, panel discussions, and election-season promises. The Marshall Islands skipped the theory phase and wired it straight into production.

The country has completed what it claims is the world’s first onchain disbursement of UBI, using a digitally native, dollar denominated sovereign bond issued on Stellar 💵

That detail matters, because this is not some token experiment.

The instrument at the center of the rollout, USDM1, is a sovereign bond issued under New York law, structured using a long established Brady bond framework.

Every unit is issued one to one against short dated U.S. bills, legally segregated and enforceable 💰️

In other words, this is traditional sovereign finance wearing a blockchain interface, not the other way around.

The program itself sits inside ENRA, the Marshall Islands’ national UBI initiative:

Until now, disbursements relied on physical cash delivery across a widely dispersed island. That setup was expensive, slow, and fragile. Digital transfers were not adopted for ideological reasons but because geography eventually wins every argument 🤔

Stellar was chosen less for narrative appeal and more for reach. The system allows funds to be distributed directly to citizens through a custom wallet application, enabling instant access without relying on physical delivery routes or centralized banking infrastructure that barely exists across many of the islands 🏦

Their thinking here is pretty straightforward.

It’s still dollars. It’s still the same public program The only real change is how it gets from the government to people. Instead of moving cash around and juggling logistics, payments now show up through a system that’s simpler to repeat and easier to manage 💱

From a crypto native angle, that’s what makes this interesting.

The chain does the transfer work and the bond carries the legal weight. Everything else stays the same. There’s no attempt to turn this into a statement about the future of money in any sort of way either 🧠

Basically the Marshall Islands treated blockchain like a practical tool for once. By fixing the part that kept causing trouble with modern tech, they pushed UBI out of theory and into regular use.

For a space that talked for years about fixing real problems, this is one of the rare moments where the result actually lines up with what was promised 😶

The dev that wanted to DESTROY Pumpfun gets 6 years in prison

Pumpfun has been printing nonstop. That, however, didn’t sit extremely well with everyone. So much so, even one of the developers eventually decided to take a blowtorch to it from the inside.

Jarrett Dunn was not some random anon throwing rocks at the project. He worked at pumpfun, he had access and he understood how the whole operation worked, which is exactly why what came next landed the way it did 👇️

At some point, the guy decided to drain millions dollars worth of Solana from the platform and send it a bunch of random of wallets 💰️

There was no elaborate cover story and the dev did not keep a low profile afterward. He went public almost immediately, posting online and framing the move as an attempt to take pumpfun down from within 🤦♂️

That framing landed with a certain demographic inside crypto 👇️

Pumpfun already had a reputation, and calling it a shitcoin factory barely counts as criticism at this point.

The platform exists to launch coins at speed, lean hard into hype, and let the market decide who gets wiped, so plenty of people were ready to believe that someone on the inside had finally snapped and tried to put a stop to it 🤔

But the story started to fall apart once the details caught up.

Instead of disappearing, Dunn kept talking. Posts turned into explanations and the more he spoke, the bigger the hole he dug for himself, the clearer it became that this was not some carefully planned takedown. It came across more like someone off his meds spiraling in public. The evidence that he wasn’t doing too good mentally stacked up around him 💊

Authorities were not impressed by the moral framing either and treated the case as abuse of position and fraud, plain and simple.

The sentence landed at six years in prison, with time already served trimming it down slightly, and none of the heroic storytelling survived contact with the court system 🤪

And while all of this was unfolding, pumpfun kept growing.

More launches came online, volume kept climbing, and fees continued rolling in, while the platform itself showed no signs of slowing down or second guessing its model. The machine kept running exactly as designed ⚙️

So the guy who tried to burn it down ended up as a footnote, while the rug conveyor belt kept moving without missing a step.

Crypto loves stories about insiders flipping the table, but in practice flipping the table in the most silly way possible, as we can see, ends with a sentencing hearing. Claiming you wanted to make a point does not help much when you leave a trail and babble nonsense about yourself along the way 🤐

At the end of the day, pumpfun was built to make money from activity, not outcomes. As long as that stays true, the house keeps winning, no matter who tries to play rebel.

US kicks crypto rules down the road, again

US policy makers had a chance to do the thing everyone keeps pretending they want to do, which is put actual rules around crypto that make sense. Instead, they did what they do best and pushed the whole mess into 2026.

The crypto market structure bill was supposed to be the big one 📜

The bill that finally draws lines, decides who watches what, and stops every enforcement action from feeling like a coin flip 🪙

Instead, it got stuck in the usual swamp of committee fights, turf wars, and regulatory jealousy, so the Senate hit pause and walked away.

At the core of the mess is the same old fight 👴

The SEC wants to keep its grip on most of the space, the CFTC wants a bigger slice, and nobody wants to be the one who signs off on something that might age badly. Add DeFi into the mix and it becomes twice as bad.

The bill itself was meant to build on CLARITY and split responsibilities in a way that lets spot markets exist without everything being treated like an unregistered security by default 🔐

On paper, that sounds reasonable. In practice, every sentence became a battlefield, especially once consumer protection and DeFi exemptions entered the chat 💣️

Some lawmakers pushed for carve outs so decentralized systems without a central operator don’t get smothered. Others argued that exemptions are how you end up with gaps that only show up after retail gets wrecked again.

Nobody fully won that argument, so the whole thing stalled.

What this means in real terms is pretty simple.

Crypto firms, exchanges, and builders stay stuck in limbo.

There’s still no clear framework, only enforcement actions, guidance by implication, lies and a growing pile of lawyers billing hours to each interpret their own BS as they see fit 🤡

Ironically, while Congress argues, regulators are doing a bit better 🧐

We’ve discussed the spot crypto trading rules changing before, access also has expanded in some areas, and products are launching under existing frameworks that were never designed for this stuff in the first place. The system is evolving, like it or not.

Pushing it to 2026 just guarantees that the rules will continue to be written indirectly, case by case, and often after damage is already done. Everyone knows this, but no one wants to be the adult in the room who locks something in ⌚️

So here we are again.

Another delay, another promise of future clarity, another year where the market moves faster than the people trying to regulate it. Crypto keeps running, politicians keep debating, and the gap between the two stays exactly where it’s been 💀

Other worthy reads

“33 Psalms for 2026: Meditations on our metamorphosis” by redphonecrypto:

Latest developments in defi, according to TheDefiInvestor:

“2026 Digital Asset Outlook: Dawn of the Institutional Era” by Grayscale:

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need