- Web3 on Fire

- Posts

- 🔥 When context becomes inconvenient for markets

🔥 When context becomes inconvenient for markets

Also: Ambire’s user count keeps ticking up 👀

GM, frens! ☕️

When you step back, almost everything follows a cycle. Growth, slowdown, reset, repeat. Nature does it without overthinking, and markets aren’t all that different. What feels like an ending is usually just the pause before things start moving again 💓

Here’s what we’re looking at this week:

🪙 When context becomes inconvenient for markets

🔥 Ambire’s user count keeps ticking up

🧲 The L2 “default setting” is ending

🔨 Court season for Binance

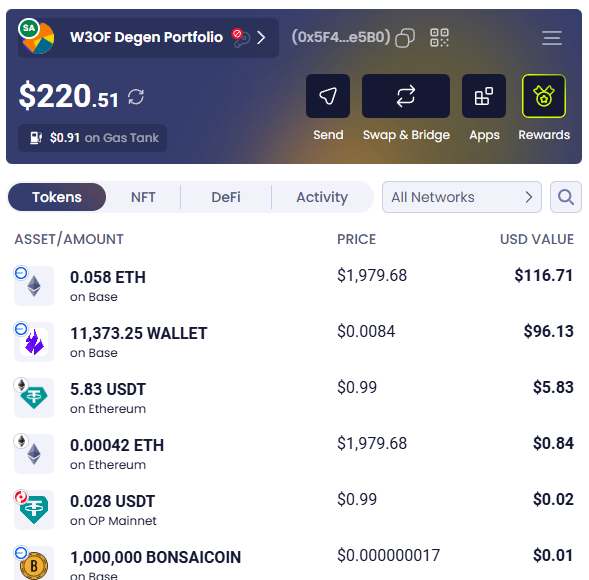

Below is how $WALLET is trading right now:

If you want to talk while the wheel keeps turning, our Discord is open.

When context becomes inconvenient for markets

We love it when we can claim that crypto is an unbothered machine. The code simply runs. Nobody cares who you are, what you did, or which billionaire’s group chat you were hanging around in 2015.

Then some new scandal drops, and suddenly the same people that won’t read a whitepaper are sprinting to post "it's over" like it’s a fire drill 🙄

This week’s trigger is the Epstein files angle: newly surfaced material and reporting that paints a picture of Jeffrey Epstein trying to get closer to early Bitcoin circles and influence Bitcoin development, mostly via introductions, emails, and money adjacent positioning 👇️

Nothing about the protocol rewrote itself. But narratives are a completely separate market, and that one isn't that simple.

The story is basically: Epstein, years after Bitcoin was already a global thing, appears in the orbit of people connected to Bitcoin Core and the broader “Bitcoin dev / research / funding” ecosystem 🪙

That includes ties that run through MIT and its Digital Currency Initiative era, plus various figures who were either working on Bitcoin directly or were prominent enough that an email mentioning them becomes a headline 🤔

In the mix are references to donations connected to MIT and the MIT Media Lab period, and later, the murkier vibe of “helping” by finding ways to fund work.

This is where the public imagination instantly jumps to a simplistic spy movie plot: shadowy financier bankrolls devs → devs become puppets → crypto becomes compromised, everyone panics.

Reality, as usual, is less cinematic: a decentralized project can still be socially penetrable because humans run emails, need money to buy food, and sometimes say “sure, intro me” before doing a background ☎️

What the reporting actually suggests

So from what’s described, Epstein wasn’t “running Bitcoin” - he was trying to insert himself into rooms where Bitcoin conversations happened, including around academic and research hubs.

The details include:

References to MIT connections and donations associated with MIT and the MIT Media Lab period 🪙

Mentions of Bitcoin Core contributors and prominent Bitcoin figures appearing in emails (but obviously inclusion in files does not automatically mean wrongdoing)

A specific thread around Jeremy Rubin, with emails that read like a now classic Epstein pattern: offer help, propose structures, suggest ways money could move that sound “practical” if you ignore who’s saying it.

Mentions of other well known crypto names appearing in the material, again more “shows up in correspondence” than “took orders”

There’s also a quote attributed to Epstein in the reporting that’s almost too perfect for crypto’s permanent contradiction museum: warnings about “pumping the currency” and it being too dangerous, while simultaneously trying to steer proximity to the project 🤫

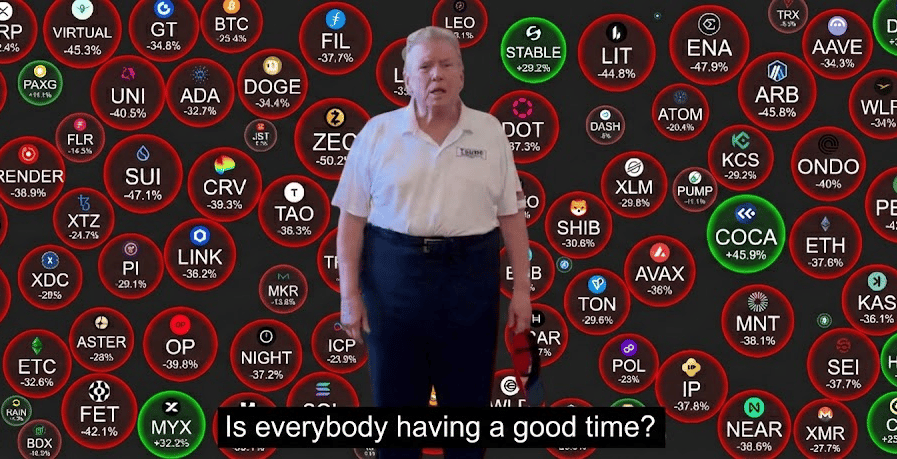

Why BS rattles the market anyway

Because crypto markets are not run by stoic engineers 🗿 they’re run by people, metas, headlines, and these things trade stories.

The whole crypto can be open source, decentralized, permissionless, and indifferent to identity, and it still sits inside a culture that can’t resist turning everything into a morality play 🤷♂️

Decentralization reduces some forms of risk, but it doesn’t delete social shock.

And an “unrelated scandal touches crypto” is basically the purest form of social shock because it’s not about fundamentals in any way, it’s about contamination 🐀

The more crypto is treated as a global neutral system, the more it becomes a magnet for every kind of symbolic war.

But the upside, at least, is that nobody really tries to “steer” irrelevant systems. Nobody writes hit pieces about whole industries that don’t matter. Attention is a backhanded compliment, even when it’s covered in grime 🤔

The dev angle people keep ignoring

Even if you assume the worst intent from Epstein, the technical reality is stubborn: the development of crypto is not a single lever you pull. It’s slow, public, contested, and built around review, rough consensus, and a community that loves disagreeing and debating more than it loves releasing a working product 👷

Influence attempts in that environment tend to land in one of two buckets:

Funding pressure: people need money to work, so grants, donors, and institutions can shape what gets researched or prioritized.

Social access: introductions and proximity can create soft influence, reputational cover, or just the appearance of alignment.

Neither bucket is good, but neither is the same thing as “guys turns out Epstein invented crypto, sell everything now”

Any ecosystem with humans in it can be socially gamed, especially when it’s early, underfunded, and still trying to look legitimate to the outside world 😐️

If a rumor is enough to make someone dump, they weren’t holding crypto as a protocol thesis, they were holding a story about themselves: that they were above the mess, above the world, above the ugly human layer.

But the human layer is always there 🤓

It shows up in funding. It shows up in conferences. It shows up in who gets quoted, who gets invited, who gets taken seriously, and who gets memory holed. You can build a network that resist coercion (and you should) but you can’t build a society of perfect actors to sit around those networks 🤷♂️

Ambire’s user count keeps ticking up

Ambire’s active user count moved from 4,000 in October 2025 to 10,000 by February 2026 🤯

That’s not a “moment” it’s a pattern: more people are keeping it installed, coming back, and actually using it. With wallets, that matters more than anything else 🔥

Wallet adoption usually leaks. People try three, rage quit two, and keep one only if it stops being a project and starts being a tool.

Going from 4k to 10k suggests Ambire is crossing that line for a growing slice of users, even if it doesn’t sound like a lot at the first glance 🥳

In the meantime, there’s a Walletcon conference during EthCC week in Cannes on March 31st that Ambire’s involved in, and it’s basically one of those places where wallet people talk shop in person, show what they’re building, and reveal what works and what doesn’t.

If you’re anywhere near it, it’s the kind of thing you can just walk into, listen for ten minutes, and immediately tell who’s solving real problems 👀

The L2 “default setting” is ending

The Ethereum ecosystem's L2 community has a special talent: it can turn a simple scaling roadmap into a civil war 🤦♂️

This time it was Vitalik, who basically said that the room of the old view of L2s as “branded shards” is aging out.

NOT because L2s are useless, but because the ecosystem has been treating them like a default setting: spawn an L2, call it scaling, collect profits.

Meanwhile, two inconvenient facts have been sitting in plain sight: Stage 2 decentralization (and interoperability, by extension) has been slower and harder than everyone wanted, and L1 itself keeps improving in ways that change the math 🤓

That’s the part that made people mad.

A lot of teams have built real product and real reputations around “L2 == the future” and they’re not completely wrong to do it.

But the point is that “the future” is starting to look less like one standardized ladder and more like a messy ecosystem where different things exist for different reasons, and the reasons need to be said out loud.

So Vitalik’s alternative view is basically: stop pretending there’s one correct L2 template. Think of L2s as a spectrum of tradeoffs 👇

Some networks will hug Ethereum’s security model as tightly as possible. Others will accept more independence because they need different constraints, different UX, different execution environments, different compliance realities, or simply because their users value a different set of guarantees ⚙️

Instead of everyone cosplaying the same product with a different logo, the question becomes: what unique function does this chain serve, and what safety assumptions does it ask users to swallow?

He even spells out the kinds of “unique function” he actually means.

Privacy. Optimization for specific applications. Designs aimed at non financial sectors like social networks, identity, and AI. Ultra high transaction speed for contexts where the priority is throughput and latency.

That list reads like a simple way of saying: if your L2 doesn’t have a strong reason to exist beyond “fees were high once” the market is going to notice 👀

There’s also a technical angle in the background that’s easy to miss if you’re only watching the discourse: he talks about making parts of the scaling stack feel more native at the protocol level.

One example mentioned is a native precompile for rollups that verifies ZK proofs on L1.

The upside is coordination. If the base protocol can offer more standardized primitives, then the ecosystem can spend less effort reinventing the same safety machinery a hundred times, and it becomes easier to keep security expectations legible for normal users.

The spicy bit is “synchronous composability,” meaning L2s interacting with each other and with L1 in a more direct, real time way, rather than living in separate time zones and hoping the glue works 🩹

So the practical takeaway isn’t “L2s are useless” like some lazy attention farmers in the space started parroting, it’s “L2s can’t all be the same story anymore” ❗️

If nothing else, it’s a good clue that Ethereum scaling has always been less about one silver bullet and more about sustained dev work, incremental improvements, and making the hardest parts simple enough that users stop noticing them.

The community’s reaction proves we’re not there yet, but it also proves the conversation finally matters 🫡

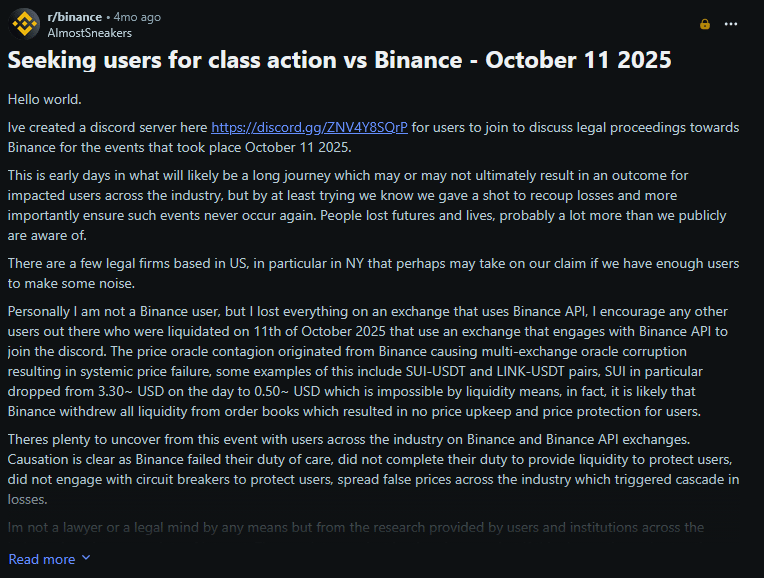

Court season for Binance

October 10 was the kind of market event people still reference in group chats with the same tone they reserve for natural disasters. What started as chaos on screens turned into a longer, uglier argument about mechanics, responsibility, and whether “this is just how it works” is an explanation or an escape hatch.

Now the aftertaste is going legal 👨⚖️

According to various sources, lawsuits and arbitrations are stacking up against Binance tied to Oct. 10 liquidations and the exchange’s alleged role in how the event played out 💀

The core complaint is not that markets can crash. Everyone in crypto already knows the drill. The complaint is that crypto broadly decoupled from major indices right on Oct. 10, then kept bleeding, and that Binance’s internal mechanisms and pricing behavior that day were not a passive bystander in the story.

Binance, as the biggest venue, had a unique role in the event, and users point to flash crash prints as low as 99.9% on the exchange that day 👎️

That kind of number is less “price discovery” and more of a court exhibit because once you accept prints like that as real enough to liquidate people, you start inviting the obvious follow up: real enough for whom? 🤐

USDE (Ethena) also reportedly traded down below $0.67 on Binance during the episode, later returning to its peg, but not before taking a reputational hit and shedding a large chunk of market cap afterward.

When a stablecoin gets dragged into a liquidation spiral, the technical debate becomes political fast, because now it is not just traders fighting traders, it is protocols, venues, and users all arguing over whose assumptions were allowed to break 🙅

Binance’s response looked like classic damage control, the exchange did not admit responsibility, but still moved quickly to pay out large sums to customers who suffered losses, with sources citing .$328 million in compensation plus another $400 million worth of loans and vouchers 💰️

There was also the attempt to restore confidence via the SAFU reserve. News reports said Binance announced it would use its entire $1 billion SAFU emergency reserve to buy bitcoin over a 30 day period 🤨

The problem is that trust is not a chart you can buy back with one big button press, especially when the narrative is already “fans turned critics” and social feeds are running daily rounds of “here’s what really happened” 🤷♂️

CZ blamed fake social media and “unrelated bitcoin traders” for the bearishness, and even tried to redirect blame toward Donald Trump and tariff headlines 🫠

That’s a defensible PR instinct, but it also explains why this is heading to court. When users can clearly see their losses came from venue specific mechanics, macro scapegoats wouldn’t work.

The larger issue is what this kind of event does to the industry’s credibility at the exact moment it keeps asking outsiders to treat it like mature finance.

Every liquidation cascade like this is a referendum on market structure, and every explanation from a CEX becomes a debate about what “fair” even means in a world where one venue can print absurd prices, trigger forced closes, then tell you they’re not to blame 🤪

If these suits keep piling up, the most expensive outcome for Binance won’t be payouts or legal fees. It will be precedent. Crypto can live with volatility but it has a harder time living with the suspicion that the rules change depending on who gets liquidated 🥴

Other worthy reads

a16zcrypto - “Blockchain needs crypto, especially now”:

The current state of crypto, according to Evgeny Gaevoy (of Wintermute):

“Reasons why crypto is down” by goodalexander:

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!