- Web3 on Fire

- Posts

- 🔥 Balancer weathers the storm - Berachain hits pause

🔥 Balancer weathers the storm - Berachain hits pause

Also: Youtube declares WAR on gambling... will GameFi get affected?

GM, frens! ☕️

Everything new in crypto is just something old with better branding, or so it seems at least. The “next big thing” usually comes wearing last cycle’s clothes, a bit polished up and pretending it never wrecked anyone before.

But maybe that’s the point? If reinvention isn’t forgetting, then it’s survival.

Here’s what we’re watching this week:

🔥 Balancer weathers the storm - Berachain hits pause

🔨 Youtube declares WAR on gambling… users fear GameFi might get affected

🪄 Quantum Money reality check

💩 Celebrity slop doubles down and STRIKES BACK

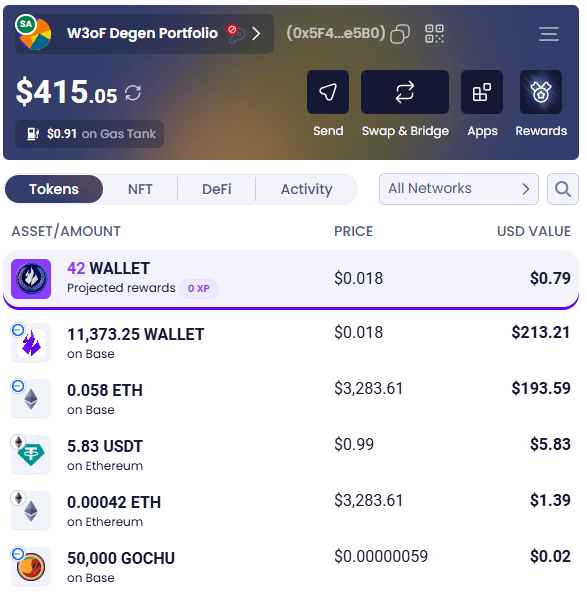

Our W3oF portfolio is basically a $WALLET core. Low drama day to day, face melter when it finally works out 👀

And btw, join our Discord, where the past never really stays buried 🙂

Balancer weathers the storm - Berachain hits pause

The morning in crypto moved at half speed on Monday, nothing urgent, the kind of day you scroll past. Then the scanners lit up 👇️

PeckShield pushed a thread: funds were walking out of Balancer v2 pools in neat, confident strides, and the number kept getting edited upward 💸

First tens of millions, then over a hundred 💰️

By lunchtime the running total had that bad roundness to it, about 128 million across chains, and everyone who had ever touched the protocol opened their dashboards with the same sinking feeling 🤯

Balancer isn’t some obscure corner farm. It’s the AMM you meet everywhere: L1s, rollups and sidechains, in younger ecosystems that cloned the code because it works.

Which is precisely why this hit like it did. Ethereum took the biggest bite, but the outflows showed up on Base, Optimism, Sonic, Polygon and friends 🧀

The onchain view had that unpleasant clarity. Drains, pauses, more drains. Core teams acknowledged an active incident and told people to hang tight while patches were tested.

Until the vulnerable pools were frozen or upgraded, the counter would keep moving, and any integrated project was suddenly in the splash zone.

As the waves spread, one network even had to halt their chain to contain the blast radius 🧨

Berachain runs an EVM L1 with a native DEX (BEX) integrated with Balancer style v2.

When alerts showed v2 pools bleeding across networks, its validators coordinated a temporary halt 🫳

The point was containment: stop block production, put sensitive paths like HONEY minting on ice, and give core devs a window to build an emergency hard fork that disconnects the risky AMM routes 🔌

$BERA wobbled - because of course, it’ll always look ugly when you press the big red button 👉️ 🔴

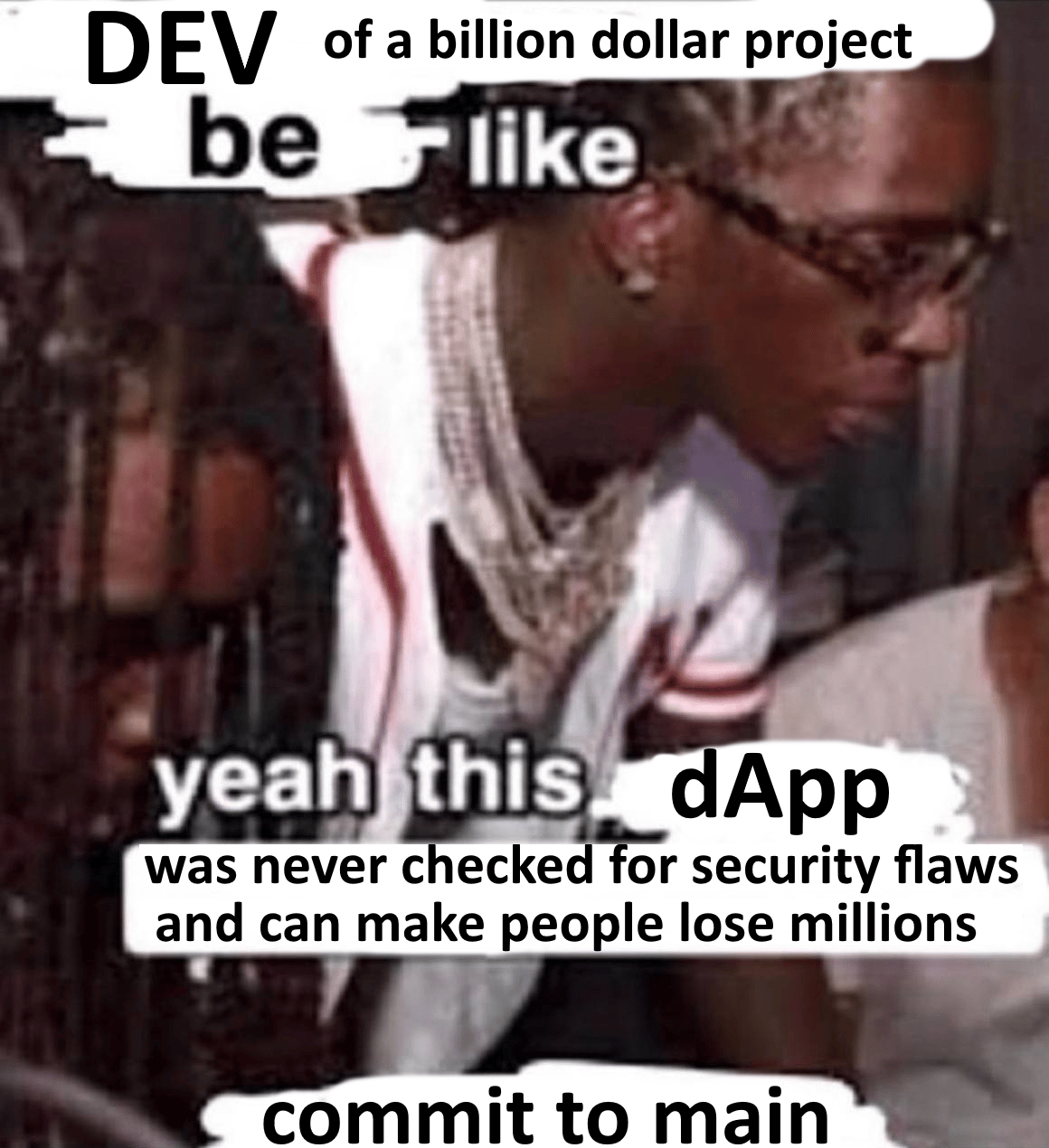

Why did this one feel heavier than the usual “farm of the week" drain?

Because Balancer is infrastructure 🛠️

When an exotic vault with ten users implodes, it’s sad. But when a base layer AMM suffers a flaw, you get cross ecosystem consequences.

For now, the running loss figure will jump around until v2 exposure is cleaned up chain by chain 💰️

But when patches arrive and all clears go out, it’s safe to say liquidity will slosh back to wherever incentives make it worth the trouble.

Youtube declares WAR on gambling… users fear GameFi might get affected

YouTube updated its policy for online gambling promotions 🎰

The change widens an existing rule that bans directing viewers to gambling services with real monetary value.

The update now calls out items used as money inside gambling flows: video game skins, cosmetics, and NFTs. The change goes live in mid November 🤓

That is the thing. The target is gambling promotion. Not gaming coverage. And not crypto in general 🤷♂️

The confusion came from the grey area where gaming touches money 👇️

Case opening content, real value skins, and casino sponsors have been pushing into mainstream gaming channels. Add NFTs, ingame tokens, and real onchain marketplaces, and the line looks thin.

Creators assumed a blanket strike on anything with “crypto” or “NFT” in the title 🤔

Then YouTube clarified to reporters that normal gaming content remains fine. Gameplay, tutorials, economy explainers, and industry news are allowed 📰

What trips the wire is promoting or funneling traffic to gambling sites that pay out in cash or cash like items 🤌

Content that features licensed operators can still appear, usually behind age gates and regional rules. “Guaranteed returns” language is a separate violation regardless of the sponsor 💵

That doesn’t mean this will be painless.

Enforcement on big platforms is messy. Flags can hit first. Appeals come later. Some channels will lose sponsor reads while teams figure out whether a partner is licensed in the right regions. Rival links may get throttled in descriptions.

So the short term looks not that great, but it’s not the end of the world and certainly no one expected this wild west to last forever 🤠

Overall it looks like platforms are tightening anything that looks like wagering with real value nowadays, whether it wears a token, a case skin, or a casino logo. Not just YT, take for example Steam that recently did a serious cleanup on their marketplace and basically erased millions in value for Counter Strike case / skin gamblers 🫠

Law enforcement and regulators are also circling the same themes. YouTube is just putting itself in front of the next round of scrutiny rather than after it.

Quantum Money reality check

Talking about taking jabs at crypto… the Quantum AI team and a few academics resurfaced a 1960s concept called “quantum money” 🧠 👇️

So the small media grifters started to ponder: if tokens are quantum states that cannot be cloned, maybe you do not need blockchains at all? 🤡

The paper sketches a mint that issues quantum tokens, users verify authenticity with physics, and double spends die because perfect copies are impossible.

It reads clever. It does not read like a drop in replacement for public crypto, though 🤓

First, what they are actually proposing 🥸

In scientists’ model there is a single issuer that prepares the tokens, hands them out, and later validates them.

Users can run local checks to see whether a token was altered or secretly tagged. If the state is wrong, the token fails. That attacks counterfeiting at the root.

Technically, it is a targeted security scheme, not a general transaction network.

What blockchains do in practice 👇️

Blockchains keep a shared ledger among strangers, across many operators, with open settlement and finality that anyone can verify.

They coordinate markets, apps, identity, and payments without a single referee. Even when cryptography evolves, the big win is social - the rules are transparent and upgrades happen in the open 🛠️

Where the two worlds diverge

Trust model: quantum money assumes an issuer users defer to. Public chains minimize that assumption by design 👑

Scope: anti counterfeiting is one slice of digital cash. Crypto handles ordering, fees, state transitions, and censorship resistance across thousands of nodes.

Hardware: quantum states are fragile. Fault tolerant machines and stable storage outside labs are a fantasy still at this point. You are not putting that in a phone secure enclave next quarter.

Auditability: blockchains give historical state for free. A quantum token can prove it is real, but does not natively expose a global ledger of who owns what and when.

Of course, there are niches where a physics check is useful 🤔

Central banks or large issuers could explore quantum verifiable vouchers inside closed systems. Settlement between a few known institutions. High-value instrument authentication. Those are controlled environments with stable links and acceptable custody rules. But none of that invalidates what crypto does, it simply adds another way to issue and verify digital objects ✔️

Plus, even Google’s own writeups place this in the “research” bucket. And if you take the fact that fully fault tolerant machines that are years out + the fact that concept often presumes a trusted validator to issue and redeem - you come closer to central bank cash with a stronger anti forgery stamp than to, say, Ethereum executing global state transitions 🤷♂️

Why the “blockchain obsolete” attention farmers miss the point 🤪

Crypto is not just preventing copies.

It is about permissionless participation and shared truth at internet scale. Yes, a lot of baggage was attached to this ever since the concept was first outlined and it’s not that simple anymore.

But you can improve anti counterfeiting with physics and still not touch the social and economic properties that make open chains useful: composability, neutrality, and a public audit trail that anyone can rebuild 🤝

End thought

Let the labs cook. If quantum money matures, it will likely live beside crypto, not instead of it. And no, it’s not going to “destroy crypto”.

Celebrity slop doubles down and STRIKES BACK

Celebrities and crypto go way back, and not in a good way.

How celebs and the space usually collide: famous people hype a coin, dump the bag, let everyone else mop up. Even courts had to get involved (think the Kim K / Mayweather era of undisclosed promos) 🤡

By 2024, the meta morphed into Solana celeb memecoins: hyped up launches, thin liquidity, bonding curves, and attention as the only utility. They rocketed, then shortly after gravity did its thing 👎️

One of those was Iggy Azalea’s $MOTHER. It exploded out of the gate in June, pulled serious volume, then bled from the highs like most culture coins do. But the market didn’t kill it completely.

To her credit, Iggy kept churning merch, brand plays, and relentlessly shilling, all in an effort to keep it alive. And now she’s back with a different thing: Thrust, a Solana based “celebrity coin launchpad” that promises to professionalize the chaos with contracts and legal stuff 🤐

It also promises structured launches, long term participation, and Azalea stepping in as creative director while migrating MOTHER to the new platform 🎩

So what’s actually new here?

The pitch says “enforceable contracts” and “defined obligations,” but that dodges the only question that matters onchain: where does cash flow come from? What protocol revenue supports holders after the first week? 🪙

Let’s be honest about the model:

Meme launchpads thrive on churn: one scammer launches a shiny coin, a few more copy it, most of them rug, rotate, repeat. It’s musical chairs with wallets. In that flow, crypto is zero sum - only someone’s loss can become someone else’s gain.

And no, a famous face won’t fix the math. Will Iggy lock in and quickly dev a zk proving system, design credible emissions? Or run liquidity incentives, architect ve-locks, or wire onchain revshare or *insert anything, literally - it’s whatever* == obviously not.

So the “utility” defaults to the only thing it’s ever had: parasocial proximity priced in basis points. It’s disingenuous, and pretending otherwise is the con. You’re just paying to stand closer to the velvet rope 🤵

If there’s a fix, it looks like an actual setup where fans could get paid from verifiable revenue, not from the next bunch of marks walking through the door 🎯

Merch splits wired to a treasury with transparent splits, usage fees routed automatically to holders, etc, some boring mechanics that outlive a quick hype cycle.

Until we see that, assume the default. If Thrust proves otherwise - great, show it and let the data do the talking. Otherwise it’s the same casino wearing a different shirt, selling proximity while the math stays undefeated 🤓

Other worthy reads

“Stimulating Into a Bubble” (Macro related) by Ray Dalio:

“How We Made +$50M Sniping Shitcoins On DEXs” by CBB:

Some thoughts about how AI bubble is going to end, from zerohedge:

MEMES

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!