- Web3 on Fire

- Posts

- 🔥 Altseason awakens - BNB flips the switch

🔥 Altseason awakens - BNB flips the switch

👀 Ambire’s buyback wallet hits $50M!

GM, frens! ☕️

The hardest time to stay sharp is when everything feels great. Euphoria blurs the edges, makes everything look like a conviction play, every pump feel permanent. That’s why discipline matters most when it feels least necessary 🧠

Feels like we’ve time warped back to 2021, with that strange sense that anything might work.

Days like these pass fast - and if you don’t pay attention, you’ll spend years remembering them instead of using them 🤔

Here’s what we’ve been watching:

🚀 Altseason awakens - BNB flips the switch

🤯 The most expensive typos in crypto

🔥 Ambire’s buyback wallet hits $50M

🤘 Onchain mourning: Ozzy’s death revives his Bats

🫠 FTX to pay out $1.9B in september (unless you’re from the wrong country)

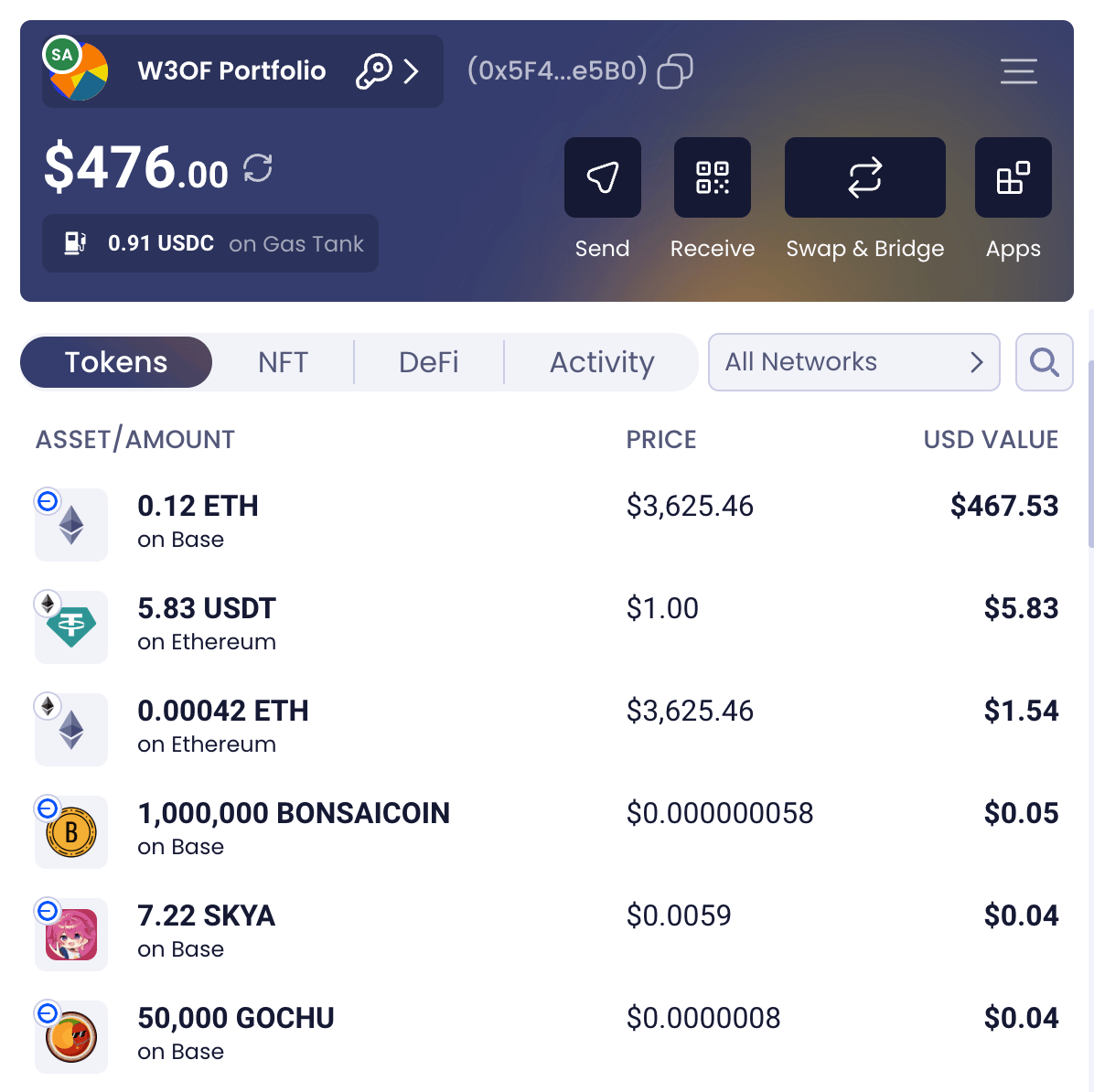

The W3oF Degen Portfolio caught the wave too, still carried, unsurprisingly, by the ETH gods smiling down on us 🫡

If you’ve got plays or just want to enjoy the moment while it lasts, come through the Discord 👑

Altseason awakens - BNB flips the switch

While BTC flirted with six figure territory and the altcoin season index quietly crept into the “greed” zone, BNB didn’t just sit there nodding politely.

It broke out, hard, printing a fresh ATH at $804 and dragging the entire BNB Chain ecosystem into a green soaked pump 🟢

The whole sector just added $24.4 billion in market cap in a single week, an ATH not just for the token, but for the entire stack of projects orbiting it 👇️

BNB’s ecosystem renaissance

BNB’s +14% weekly jump was the headliner, but it was far from alone.

Holy fuck!

$BNB with a new all time high today.

Congrats to @cz_binance and everyone else who had more diamond hands than me who should've held some of my buys from $4-15.

— VikingXBT (@VikingXBT)

6:41 AM • Jul 23, 2025

BEP-20s lit up like it was 2021 again 👀

Spark (SPK) ripped +250% off the back of staking hype from their Ignition Airdrop Phase 2. DIA doubled after announcing back-to-back partnerships with Hydration and Plume. Even Smooth Love Potion (SLP) caught a +65% bid for reasons nobody can quite pin down, but nobody’s really complaining either.

Tagger (TAG) and Caldera (ERA) pumped too - off the back of incentive program cash and a Binance + Coinbase double listing, respectively. The party wasn't for everyone though: a few stragglers like 1INCH and CHEX didn’t catch the wave and sank double digits. Can’t all be winners.

Still, the winners vastly outweighed the losers. And in the thick of it, BNB Chain quietly flexed on its L1 peers 💪

Per data, it’s beating out Solana on real (non vote spam) daily transactions and stablecoin daily transactions. It’s neck and neck with TRON on daily active addresses. And in terms of DEX volume BNB Chain is comfortably pushing $9 billion a day - no small feat for a chain once ridiculed as the “Sh%tcoin Casino” 🃏

$BNB Chain outperforms other competitors in teams of active addresses when it comes to stablecoin usage 🔥

Closest competitor is $TRON with 9.6 million active addresses while $BNB chain has 11.8 million 🔝 With its lightning-fast transactions, low fees, and wide ecosystem, it's

— Crypto Raven (@hiRavenCrypto)

3:05 PM • Jul 24, 2025

TVL followed suit, climbing +9.4% this week, driven by Binance Staked ETH flows and the general lift in sentiment. There’s real money moving in again.

Behind the pump: treasury accumulation and infra flexing

This isn’t just because of retail, institutional bags are also getting packed 💰️

Nano Labs, a Hong Kong chipmaker, now holds 120,000 BNB and plans to keep stacking.

📢 Update from Nano Labs (Nasdaq: $NA)

We’ve significantly increased our $BNB holdings to 120,000 BNB (~$90M), acquired at an avg. cost of $707/token — a major milestone in upgrading our BNB strategic reserve. 🔒📈

We’re building for the future of Web3.

🔗

— Nano Labs (@NanoLabsLtd)

10:50 AM • Jul 22, 2025

Meanwhile, Windtree Therapeutics isn’t playing small ball either, they just announced a multi million BNB treasury strategy.

Windtree has entered into a Common Stock Purchase Agreement for up to $500 million to establish an equity line of credit and bolster its BNB cryptocurrency treasury strategy. Learn more: bit.ly/4meJ0nm $WINT

— Windtreetx (@windtreetx)

1:18 PM • Jul 24, 2025

This coordinated accumulation adds credibility to BNB’s positioning, not just as a trading token, but as a long term balance sheet asset 📈

Meanwhile, the chain itself is leveling up as well.

BNB Chain devs are teasing an ultra fast private L1 with sub 150ms finality, a 20K TPS ceiling, native privacy features, a Rust client, and a 10x gas limit bump 🤓

BNB Chain is entering its next era.

We're bringing a CEX-level experience to a decentralized, permissionless blockchain. All without sacrificing what makes Web3 powerful.

Here’s what’s coming next 🧵👇

— BNB Chain (@BNBCHAIN)

12:47 PM • Jul 16, 2025

It reads like a Solana killer pitch deck, but this time it’s coming from a chain with actual usage and momentum so it might be interesting.

Altseason seeds are sprouting

The altcoin season index (from CMC) jumped from 20 to 55 in June before cooling slightly. It hasn’t hit the euphoric 75 mark yet, but the appetite is clearly back 💲

With the GENIUS and CLARITY Acts thawing some of the regulatory ice, and macroeconomic gloom fading into the rear view, the setup feels eerily like Q1 2021 🙃

Altseason 2025 is mirroring 2021 step by step.

Wave 5 complete.

Breakout confirmed.

Vertical phase pending.What happened next in 2021?

A face-melting altcoin rally.2021 turned believers into millionaires.

2025 is already in motion.DON'T GET SHAKEN OUT!

— Merlijn The Trader (@MerlijnTrader)

6:00 PM • Jul 24, 2025

Eyes on 2026

BNB is now fully out of its year long consolidation dungeon. From the June bounce to this week’s $804 high, it’s been a steep climb. And yet, it still doesn’t feel over.

Build and Build. $BNB

Appreciations to all the ecosystem players, BTC maxis, ETH holders, meme traders, ETF applicants, treasury pub cos, good regulators, and utility builders. 🙏

— CZ 🔶 BNB (@cz_binance)

2:39 AM • Jul 23, 2025

If support holds and the ascending channel plays out, there’s a decent shot at a clean break above $810. After that, the next target sits at $894, a 16.5% pump that could trigger a round of price discovery we haven’t seen since BNB was playing third fiddle to ETH and DOT in 2021 🤔

Meanwhile, ETH itself is quietly stacking its own bull case.

Spot ETH ETFs have raked in nearly $4 billion over 13 straight days of inflows. Price is up 64% in the past month. Options traders are eyeing $4K by September and $10K by year-end. And while it’s seen some short term selling pressure around $3,640, mostly from whales locking in gains, fresh demand is absorbing the dump 🏋️

Glassnode’s distribution heatmaps suggest a healthy equilibrium: strategic profit-taking on one end, institutional accumulation on the other. Onchain open interest in ETH futures just hit $58B.

Last week, #Ethereum spot ETFs saw inflows of over 588K $ETH - nearly 17x the historical average and more than double the previous record.

— glassnode (@glassnode)

9:36 AM • Jul 22, 2025

Block gas limit just got bumped from 36M to 45M units (a 25% capacity jump) paving the way for more throughput ahead of the bigger 60M and 150M targets tied to EIP-7935 and the upcoming Fusaka upgrade. And to keep it from nuking itself, devs deployed EIP-7983 to cap per-tx gas and avoid DoS risks.

The altcoin season might not be official yet, but if you squint a little, it’s already here 👀

The most expensive typos in crypto

Talking about ETH… here’s a funny stat that surfaced recently:

Roughly $3.4 billion worth of Ether is gone forever - but it wasn’t rugged or stolen - it actually vanished into the digital abyss thanks to plain old user error and some smart contract bugs 🫠

According to Coinbase’s Conor Grogan, that number represents over 913,000 ETH irretrievably lost, amounting to 0.76% of Ethereum’s total supply. That’s nearly 1 in every 130 ETH permanently out of circulation, just because people clicked the wrong thing or deployed a bad contract 🤦♂️

Grogan’s estimate doesn’t even cover the full scope of losses. It excludes lost keys, dormant Genesis wallets, and all the dusty, untouched ETH that’s basically museum grade at this point 🗿

His figure only counts ETH that’s provably stuck - meaning technically there, but functionally dead.

Based on my research, a minimum of 913,111 Ethereum is lost forever due to user error. This is 0.76%+ of ETH supply, or $3.43 billion in lost funds

If we include EIP‑1559 burned ETH (5.3M), then >5% of all ETH ever made ($23.42B) have been permanently destroyed

— Conor (@jconorgrogan)

10:01 PM • Jul 20, 2025

A graveyard of ghost coins

The tally also includes some of Ethereum’s most infamous black holes:

306,000 ETH from the Parity Multisig bug, which froze the Web3 Foundation’s war chest in 2017.

60,000 ETH locked away by Quadriga. Quadriga’s founder died and took the keys to a ~ $300M (actually worth many billions now) portfolio to his grave back in 2019 💀

11,500 ETH vaporized during the Akutars NFT mint, a disaster of a launch that cost the buyers $20 million (a live action tutorial on how not to write Solidity) 😐️

And then there’s the burn address, a digital trash can that now holds 1,000 more ETH than it did in 2023 🗑️

To be clear, this $3.4B+ number significantly undershoots the actual lost/inaccessible ETH amount- It just covers instances where Ethereum is locked forever.

For example, it doesn't cover all lost private keys or things like Genesis wallets that have been forgotten

— Conor (@jconorgrogan)

10:01 PM • Jul 20, 2025

But that’s just the accidental part.

If you include Ethereum’s intentional burn mechanism, EIP-1559, which has torched 5.3 million ETH since 2021, the total lost supply balloons to 6.2 million ETH, or about 5% of all existing Ether 🤯

That’s $23.4 billion, permanently removed from the market. For comparison, that’s more than the market cap of Uniswap, Arbitrum, and Starknet combined 🧠

Bitcoin maxis love to remind everyone that ETH doesn’t have a hard cap. But maybe it doesn’t need one when people keep accidentally setting it on fire 😅

And from a supply dynamics angle, all this missing ETH might actually be good news. It’s a reduction without central planning, a pseudo cap enforced not by protocol rules, but by irreversible mistakes 🤷♂️

Ambire’s buyback wallet hits 50M $WALLET

Over 50 million $WALLET tokens have been bought back into Ambire’s public treasury wallet, all sourced from protocol fees like swap, bridge, and network charges 👀

Following $WALLET buybacks? Now it's simpler, track one of our public treasury wallets: buybacks.ambire.eth

So far it has incurred >50 million $WALLET and counting.

This address is intentionally excluded from Ambire Rewards, as are other treasury addresses.

— ambire.eth (@AmbireWallet)

11:28 AM • Jul 17, 2025

No BS, just a steady stream powered by actual usage 🔥

The wallet is public and tracked. Rewards are kept separate. What you see is what’s been earned 💰️ 💰️

Funfact: Ambire’s market cap is ~30x lower than Trust Wallet. Just something to think about.

By the way…

We’re still doing user interviews. If you’ve never touched Ambire before, we want your fresh eyes 👁️

Looking for some fresh eyes 👀

If you’ve never used @AmbireWallet, I’d love to invite you to a user interview.

Here's what it's all about: ambire.com/user-interviews

(live view from past interviews, it's fun i promise :D)

— Cinesius (@cinesiusss)

8:33 AM • Jul 24, 2025

Onchain mourning: Ozzy’s death revives his Bats

Ozzy Osbourne’s death might’ve silenced the Prince of Darkness, but it just resuscitated the floor price of a collection many had already buried 🦇

Within hours of the announcement, his old collection, CryptoBatz NFTs surged over 400% in value. From a forgettable 0.02 ETH to 0.08 ETH in a heartbeat – or more fittingly, a bite. Trading volume was up 100,000% 📈

It’s the most attention these JPEGs have seen since a long time ago.

🚨BREAKING NEWS - @OzzyOsbourne just died and his ETH NFT collection is going wild.

The Cryptobatz NFT floor has gone from 0.02 ETH to 0.1 ETH and volume is rising…is this the first NFT collection from a celebrity who has died? 🤔

— RIDDLΞR (@RiddlerNFT)

6:22 PM • Jul 22, 2025

Osbourne’s NFT collection was always a meme wrapped in a reference. Born in late 2021 during peak JPEG mania, the CryptoBatz drop featured 9,666 digital bats with the gimmick of “biting” other NFTs to spawn hybrids 🤔

BAYC, Alien Frenz, Cyberkongz and some others all were fair game for Ozzy’s bite mechanic.

The whole thing was a nod to his infamous 1982 bat head stunt, which by today’s standards would’ve probably earned him a 72 hour cancellation cycle and a podcast interview redemption arc 🤐

I’m launching a fucking NFT project. 9,666 unique bats designed by yours truly...

go and follow @CryptoBatzNFT and read all about it below 🦇

rollingstone.co.uk/music/news/exc…— Ozzy Osbourne (@OzzyOsbourne)

6:09 PM • Dec 27, 2021

Now, due to his passing, it’s all coming full circle, the bats are feeding again.

Over $280K in trading volume within 24 hours, nearly eclipsing the entire market cap of the collection. It’s a flurry of speculative necromancy, the kind of rally that only NFTs and obituary headlines can conjure.

And let’s be honest: this wasn’t about the art, or even the tech. It was a collective moment of onchain sentimentality. A moment where traders decided they wanted to own a tiny piece of an icon – even if that piece was a cartoon bat with metadata 🐒

RIP Legend. A man bites a bat, decades later that bat bites a monkey JPEG, and somehow it all ends up onchain.

If that’s not web3, what is?

FTX to pay out $1.9B in september (unless you’re from the wrong country)

Third time’s the charm, or so it goes, if your passport’s on the approved list 🤦♂️

FTX’s bankruptcy estate has scheduled its next $1.9 billion cash distribution to creditors, set for September 30.

The funds come from a once frozen pool of claims that are now, legally speaking, “no longer in dispute” 👨⚖️

🚨 FTX sets Sept 30, 2025, for next creditor payout after slashing disputed claims reserve by $1.9B to $4.3B!

💸 Distributions via BitGo, Kraken, Payoneer for Class 5 & 6 claims.

‼️KYC by Aug 15 to cash in!

— CryptoPotato Official (@Crypto_Potato)

4:07 AM • Jul 24, 2025

This will be the third payout since FTX fell - $1.2 billion landed in February, $5 billion in May, and now this next round, drawn from the $2.2 billion thawed by the court after slashing the “disputed claims” reserve from $6.5B to $4.3B 💰️ 💰️

But here’s the thing: a good chunk of that $4.3 billion still sits on the bench, and some of it is looking very red.

If you’re based in China - or one of the 48 other jurisdictions that FTX’s legal team flagged as “restricted” - you may want to sit this one out.

Those claims are “nearly certainly” excluded from the September drop, as the court is still figuring out what to do with anyone residing in places where crypto laws are vague, hostile, or simply inconvenient.

FTX: Restricted countries

Disputed claims49 Jurisdictions -5% allowed claims in restricted countries 82% of value in China

Due to local laws that 1) crypto currency trading is not permitted or 2) distributors not allowed

— Sunil (FTX Creditor Champion) (@sunil_trades)

1:22 PM • Jul 3, 2025

The controversial motion to freeze these 49 jurisdictions blew up spectacularly after over 90 creditors filed objections, forcing the estate to hit pause and rework the proposal.

A federal judge approved the delay this week but made it clear: if the estate wants to gate funds based on geography, they need to write an actual rulebook, not a vibes based blacklist 📜

FTX Restricted Jurisdictions: Why @ftxcreditor_com is right and why it is actually worse than they think.

TL/DR: The process, if approved by Judge Owens, is designed to make it highly likely these claims go to $0. Selling *might* avoid the issue but that's not a guarantee.

— Mr. Purple (@MrPurple_DJ)

9:29 AM • Jul 10, 2025

So who’s actually getting paid?

The (kinda) good news If your claim is already allowed, and you’ve already received a partial payout over $50K, you’ll likely see another payout soon ✉️

The record date is August 15 - so by then, the estate hopes to finalize who gets the green light.

The bad news is that if your claim falls into the still frozen $4.3B pile, you’ll be waiting. And if you’re from the wrong jurisdiction, you might be waiting indefinitely 🙄

So far, the FTX estate has stuck to its repayment promises more diligently than most would’ve guessed after the initial crater.

But the whiff of selective exclusion, opaque frameworks, and the geopolitical dodgeball of “restricted jurisdictions” is turning what should be a clean exit into yet another mess.

Other worthy reads

Some alpha on history of Tether, from Austin Campbell:

My best guesses on Tether, based on a lot of sources I won't disclose:

There was a period in the early days where I suspect they either had a small hole or did not have all the funds in liquid fashion (e.g. could not have survived large redemptions). I think this was largely due

— Austin Campbell (@CampbellJAustin)

2:29 AM • Jul 24, 2025

“The Great Onchain Migration” by Franklin Bi:

The Great Onchain Migration

A New Fintech Playbook: Tokenization as a Gravity Well

In 2025, tokenization crossed from concept into inevitability.

It’s been nearly a decade since I helped draft J.P. Morgan’s first designs for asset tokenization. At the time, the idea that

— Franklin Bi (@FranklinBi)

6:41 PM • Jul 23, 2025

“The Institutional Research Playbook” by Rubiks:

𝐓𝐡𝐞 𝐈𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐚𝐥 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐥𝐚𝐲𝐛𝐨𝐨𝐤

There’s a good play here, but no content in it.

This is the reality of most market narratives at the moment. ETF flows are hitting records. Institutions are milking supply faster than retail can react. RWA

— ℝ𝕦𝕓𝕚𝕜𝕤 (@RubiksWeb3hub)

11:06 AM • Jul 21, 2025

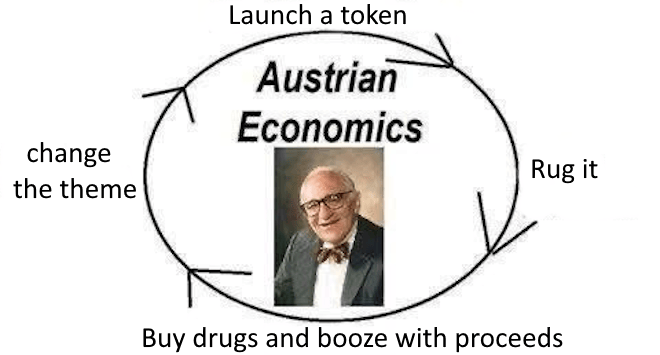

MEMES

super impressive fr

— Alan Carroll (@alancarroII)

4:37 PM • Jul 24, 2025

That's all for now, frens.

We'll meet in a week! And remember, the market conditions are temporary, but our commitment to building a better Web3 is here to stay. Thanks for joining us, and we look forward to seeing you back next week. Cheers!

Yours, The 🔥 Team

Brought to you by Ambire: The Only Web3 Wallet That You’ll Need!